Hi Tony,

After writing about the concerns of inflation last week, can you expand on the type of investments that are likely to keep ahead of inflation. I currently have a rental property so I guess trying to raise the rent in line with inflation is a start there. My share potfolio consists of the likes of the 4 Banks plus BOQ, Telstra, Woolies, Westfarmers and BHP. I’d be appreciative of any comments.

Regards,

Mike

A: Hi Mike,

Thanks for the question to Tony about assets and inflation.

He thought I might be better placed to address it.

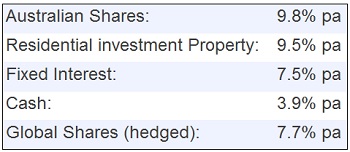

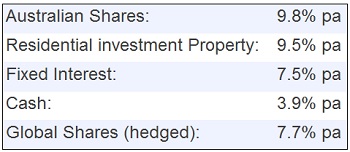

Typically, growth based assets will outperform inflation over the long term. According to the ASX/Russell Investments ‘Long Term Investing Report’ (attached), over the 20 years to December 2012, the gross return on individual asset classes has been as follows:

Inflation over this period has been 2.7%.

These returns are pre-tax.

I have attached the report for your information. In particular, it also details the returns on an after tax basis – arguably, this is what you should be considering.

So, if you want protection from inflation over the longer term, consider growth based assets, in particular, shares. In relation to your specific portfolio, you haven’t provided any individual share weightings so it is a little hard to comment – however, it looks like your weighting is towards higher dividend/lower growth stocks, rather than stocks expecting strong revenue growth.