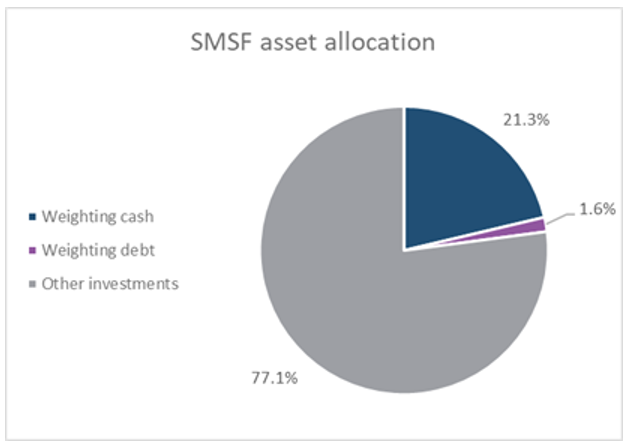

The shock collapse of the stock market when the Coronavirus came to town underlined how important it is to have a diversified collection of assets in your super fund or investment portfolio. And while that market crash of February to March this year was worrying, one of the scariest financial facts out there is that SMSF trustees have told the ATO that they have 21.3% of their assets in cash and term deposits! With cash rates where they are, these investments are being outpaced by inflation, meaning they are essentially going backwards in value. Despite the overweight to cash, other low-risk investments like bonds and debt (which can complement cash and term deposits) represent just 1.6% of the average SMSF portfolio!

Source: ATO

This is a capital-killing strategy for anyone’s all-important nest egg.

We all long for the days when term deposits were 5%, but these levels won’t be returning for donkey’s days. As a result, in the meantime SMSFers could be eating into their capital because they’re too scared to grow it!

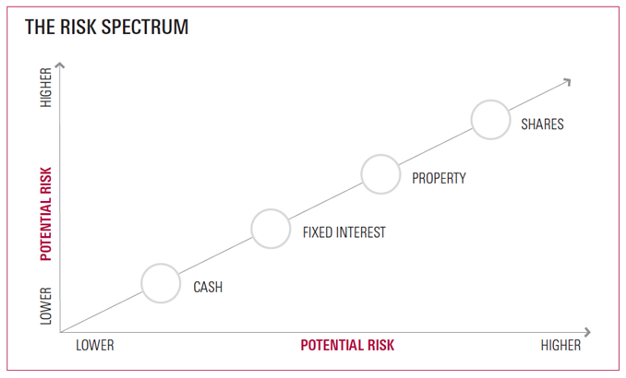

There are no real exact alternatives to a government guaranteed term deposit with a limit of $250,000, so if a super trustee wants to try and defend or grow their nest egg, they have to go up the yield curve and take on more risk. But this doesn’t mean SMSFs need to bet the house. Part of the solution could be as simple as diversifying some of that cash into other low-risk investments like fixed interest and bonds.

Source: Switzer Financial Group

This is the sensible way to address capital concerns. To make it relatively safer, we make sure our financial planning clients are diversified. This doesn’t mean you can’t lose capital in the short term but, over time, quality assets head up, which means those who manage their own super money need to think like professionals.

Professional money managers know that they can get it wrong in the short term but, over the longer term, their investment processes are tried and tested, which assures them they will make money investing in quality assets.

My concern for DIY super people and their excessive exposure to cash (which is paying negative real returns right now!) got me talking to one of Australia’s best bond fund managers, Chris Joye, the founder of Coolabah Capital Investments (Coolabah) and a regular contributor to The Australian Financial Review.

Long-time readers and TV watchers of my work know I’ve interviewed and quoted Chris for over a decade. I believe he’s one of Australia’s smartest and best money managers.

When it comes to stocks, I like to do my own homework and then check out the views of smart people who I respect. This includes talking to company analysts, fund managers, CEOs, etc. Then I see if the technical chart reinforces the positive or negative view on a company.

But when it comes to fixed income, I look for expertise from people who have a great performance history.

Joye has a team of over 25 executives, including five full-time portfolio managers and 13 full-time analysts, with decades of fixed-interest trading, quant and credit research experience. They’re charged with looking at the best way of making money out of largely safe government bonds, with a smaller exposure to bank hybrids, company bonds and so one. His track record is impressive in an area where few investors have expertise. That’s why I asked Chris and his team to manage my Switzer Higher Yield Fund (SHYF).

In 2019, the portfolio managers at Coolabah were selected as one of FE fundinfo’s Top 11 “Alpha Managers” based on their risk-adjusted performance across all asset classes.

This fund’s goal is to deliver 1.5% to 3% above the RBA cash rate and, given CCI’s track record, I suspect there’s a good chance that this target is consistently achievable.

This is how CCI explains its objective and strategy, which in part explains why I have recruited the Joye team.

Objective: A strategy targeting low-risk cash and fixed-income returns that exceed the RBA’s cash rate by 1.5% to 3.0% pa after fees, over rolling 12-month periods.

Strategy: We actively invest in a diversified portfolio of Australian deposits, investment grade floating-rate notes and hybrid securities, with a weighted-average “A” credit rating. We do not invest in fixed-rate bonds (unless interest rate risk is hedged), direct loans, use leverage, or take currency risk. We add value via active asset selection using a range of valuation models with the aim of:

- Delivering lower portfolio volatility than traditional bond funds;

- Providing superior risk-adjusted returns, or alpha, without explicitly seeking interest rate risk, credit risk or liquidity risk.

The Switzer Higher Yield Fund will be multi-distributed, meaning you can invest via a broker or by filling out an application form on the Switzer Asset Management website.

My final words…

If you’re unhappy with your returns from your investments or your super fund, consider what Tony Robbins once observed: “If you do what you’ve always done, you’ll get what you’ve always gotten.”

And former US Secretary of State Colin Powell gave us all good guidance for running our investments when he said: “There are no secrets to success. It is the result of preparation, hard work, and learning from failure.”

I’ve spent my entire life trying to help others avoid failure. Learning from people who are smarter than me has been at the core of my success strategy.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.