The Australian stock market is now down 4.35% year-to-date. If you throw in dividends and franking, someone who’s simply in an ETF for the overall market will be into positive territory! And if the December 13 US inflation number is better-than-expected, the Santa Claus rally into year’s end could give me the 10% gain for stocks I once tipped earlier in the year.

Given this year’s headwinds, that would be incredible!

That was pre-Putin, and China’s COVID rerun and zero virus policy, which kept inflation higher than was forecasted and meant central banks had to go harder on interest rate rises than was expected. This is the stuff that explains why we say stocks climb a wall of worry, but they do climb.

This five-year chart of the S&P/ASX 200 Index reminds us why we’re in stocks for the long term.

S&P/ASX 200

That’s a 21.2% gain over five years. If you throw in dividends and franking, there’s 10% plus per annum. And that’s with the damn virus and the challenges of the Trump versus China trade war, global lockdowns, the Ukraine war, spiking energy prices and a world economy without a normal fast-growing China. With all of that, stocks still delivered 10% plus per annum!

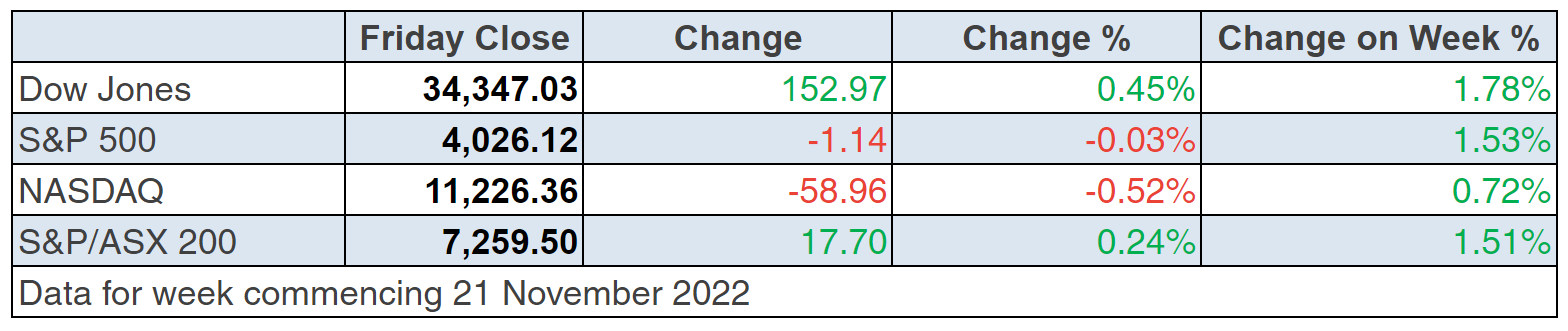

US stocks finished the week up, with data, minutes from the last Fed interest rate meeting and comments from Fed officials all helping to sustain this rally.

We’re still not sure if this is a bear market rally. I suspect December 13’s CPI in the US could decide the issue.

But these minutes from the US Federal Reserve Open Market Committee (FOMC) monetary policy meeting on November 1-2 were what the market loved to see in black and white: “A substantial majority of participants judged that a slowing in the pace of [interest rate] increase would likely be appropriate”.

The market also liked this from San Francisco Federal Reserve President Mary Daly, who warned that too much policy tightening could be “unnecessarily painful” for the US economy.

But wait, there was more. Note this from the Federal Reserve Bank of Cleveland President Loretta Mester, who said: “I think we can slow down from the 75 [basis point rate hikes] at the next meeting”.

For your information, the next FOMC meeting is over December 13-14, so the interest rate deciding group will see the latest CPI reading and that will be the November number.

Overnight, on a Black Friday shortened trading day, the Dow was up 152 points (or 0.45%), the S&P 500 was down only 0.03% but the Nasdaq lost 0.52%, with many tech companies still on the outer.

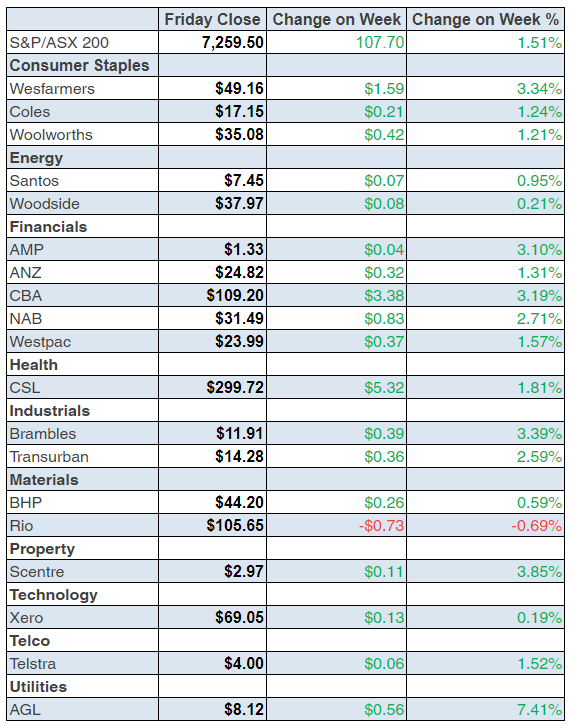

To the local story and the S&P/ASX 200 gained a convincing 107 points (or 1.51%) for the week, which makes optimists believe that US inflation is on the slide and interest rate rises are nearing an end.

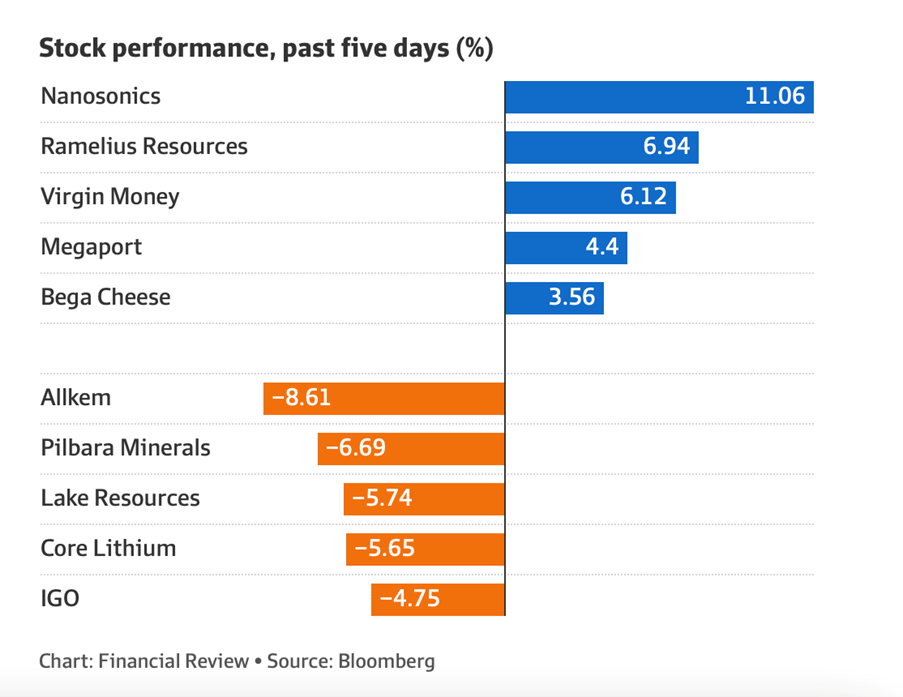

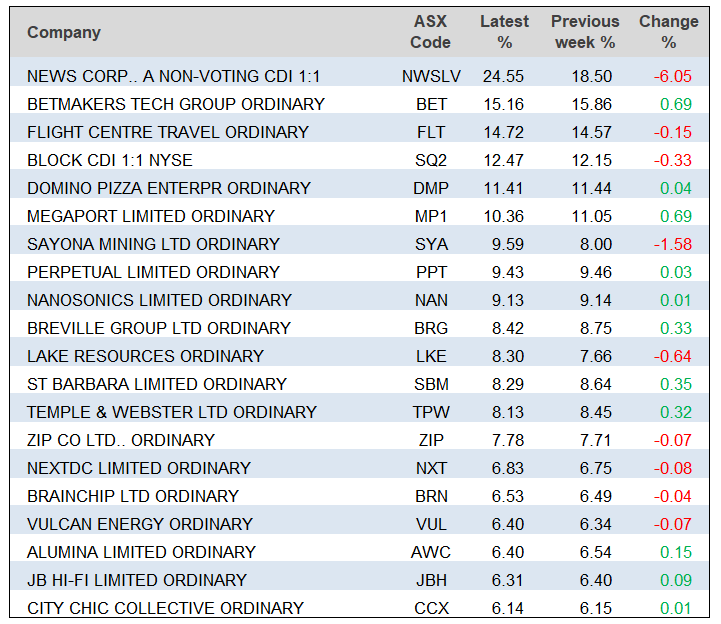

Here are the big winners and losers, courtesy of Bloomberg and the AFR.

The CBA had a nice week, rising 2.44% to $109.20, which has defied the analysts who have been too negative on the best bank in the place. The second best, NAB, rose 1.91% to $31.49, while Westpac rose 0.71% to $23.99 and ANZ was up 0.45% to $24.82.

And what about Virgin Money (VUK), which was up an inexplicable 20.93% to $3.12.

EML was up 32% for the week, with the chairman ditched and takeover talk driving up the share price.

For those interested in Tyro, the chair David Thodey resigned after doing little for the company. Meanwhile, my colleague Paul Rickard was returned with big support. Interestingly, Westpac is still circling to buy the company at a price below $2, which would be a steal! Luckily, The Australian’s DataRoom understands that earlier, Canadian payments group Moneris had been in informal talks to buy Tyro, so it could well be the suitor. Moneris is Canada’s largest financial technology company that specialises in payment processing and was established as a joint venture in 2000 between the Royal Bank of Canada and Bank of Montreal. This company doesn’t need to be sold until tech and payments companies get back in favour and the share price is a lot higher.

What I liked

- The Ifo Institute in Germany reported a business climate index of 86.3, higher than analysts’ forecast of 85 in a Reuters poll, and following a revised reading of 84.5 in October.

- The US Nymex oil price fell by 10% last week. The S&P/ASX 200 Energy sector fell 1.3%.

- The S&P Global manufacturing index fell from 50.4 to 47.6 in November (survey: 50). This small fall is good for inflation and for believing a US recession is avoidable.)

- The S&P Global services index eased from 47.8 to 46.1 in November (survey: 48).

- The University of Michigan consumer sentiment index fell from 59.9 to 56.8 in November (survey: 55).

- The Chicago Federal Reserve national activity index fell from 0.17 to -0.05 in October (survey: flat).

What I didn’t like

- The S&P Global Australia composite purchasing managers’ index hit a 10-month low of 47.7 in November. We need to slowdown and that’s good but I didn’t like seeing that the survey said “…price pressures are worsening”.

- The latest meeting minutes of theEuropean Central Bank (ECB)showed policymakers feared that inflation may be getting entrenched, justifying more rate hikes, but Reuters noted “for how long and how much remained a debate”.

- Investors worried that China may again ramp up Covid restrictions after reporting several deaths over the weekend.

- Putin’s warnings about price caps on oil. (On Tuesday, the US Treasury Department said that Washington and its allies were now planning to finalize a price cap for Russian oil in “the next few days”, as they seek to cut off a critical source of funding for Moscow.)

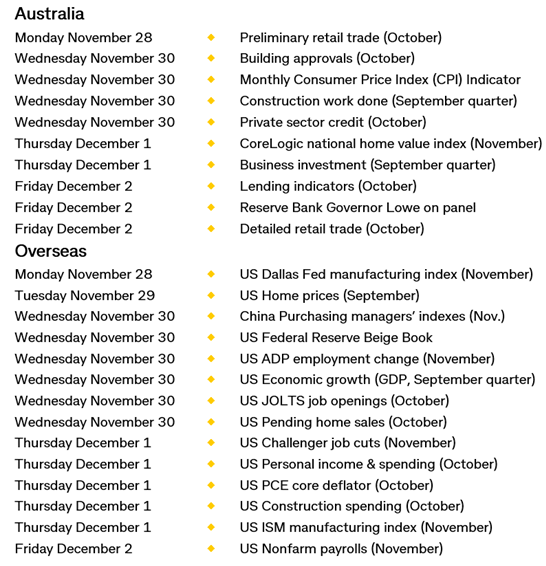

Big watches for next week

The US jobs report on Friday (US time) is a real biggie as it will have implications for inflation and what the Fed will do at the December meeting. However, there’s another biggie on Thursday, when the Yanks see the PCE core deflator, which is an important inflation indicator that the Fed treats very seriously — even more than the CPI! There could be some real stock market action next week in either direction.

The week in review:

- In this week’s Switzer Report, I talk about 10 stocks I think look good for 2023: here are my best buys right now going into 2023

- Paul Rickard talks about how he thinks Ramsay is a good stock that offers value for long-term investors: Ramsay is a stock that a serious group of investors was prepared to pay $88.00 per share for, now trading almost 30% lower at $62.42, should be an interesting proposition. Moreover, it is trading near Covid lows.

- Tony Featherstone talks about three A-REIT ideas that he thinks will be great to invest in for 2023: While the sector has many headwinds, these themes have good long-term prospects.

- James Dunn discusses four gas stocks he thinks could rise soon: while the sector has many headwinds, these themes have good long-term prospects.

- In our “HOT” stocks column today, Michael Gable, Managing Director of Fairmont Equities, tells us why he likes Evolution Mining (EVN).

- In Buy, Hold, Sell – Brokers Say, there were 8 upgrades and 13 downgrades in the first edition and 3 upgrades and 9 downgrades in the second edition.

- And finally, In Paul’s (Rickard) Questions of the Week, Paul answers your queries on What is the easiest way to keep track of the US markets? Rare earths producer, Australian Strategic Materials, has fallen like a stone. It is now raising capital through a SPP. Should I participate? Was the Qantas trading update that great? Why all the fuss? Do the broker analysts prefer Woolworths or Coles?

Our videos of the week:

- The broker’s and the chartist’s view on these ASX stocks: SFR, ALL, RMD, MCR, RHC, XERO, AMP & more! | Switzer Investing (Monday)

- Can we trust this market rally? If we can, is tech set for a big rebound? + is AMP a rebound stock? | Mad about Money

- Boom! Doom! Zoom! | 24 November 2022

- Peter Switzer reveals his 3 favourite stocks + expert explains the recent crypto crash! | Switzer Investing (Thursday)

Top Stocks – how they fared:

The Week Ahead:

Food for thought: “Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.”– Paul Samuelson

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

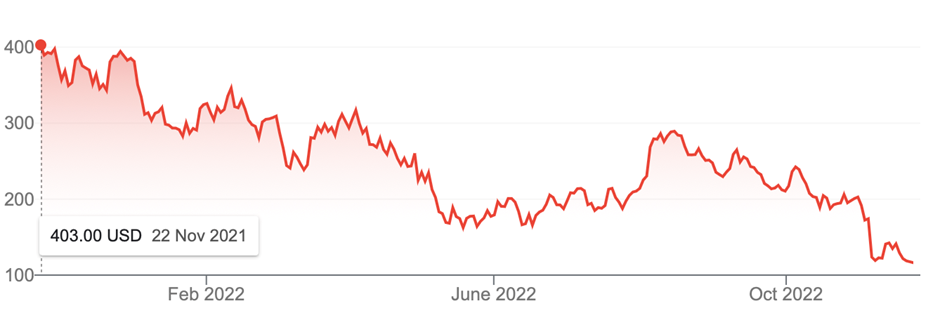

Chart of the week:

It’s intriguing that some poop-dropping bats, along with tasty raw snakes and adventurous diners in Wuhan could have threatened the world with a Great Depression that was averted. But it all led to a global lockdown, a stock market crash, record low interest rates, followed by surging inflation and then a rapid rise in interest rates.

And one of the big casualties of the strange eating in China has been tech companies, whose stock prices have been smashed, such that the Bloomberg reports that Tesla’s “Elon Musk’s losses for 2022 have topped $US100 billion ($151.4 billion) as shares of Tesla dropped to the lowest level in two years.”

But Musk is not alone, with the likes of our own homegrown billionaire Mike Cannon-Brookes losing billions, as the share price of his Atlassian tumbled with other tech stocks.

This is how The Australian’s David Swan reported a big fall on November 25: “Shares in Australian software giant Atlassian slumped by more than 20 per cent in after hours trading on Friday, wiping billions from the company’s valuation and the net worth of its co-CEOs Mike Cannon-Brookes and Scott Farquhar in minutes, after the company swung to an annual operating loss and posted earnings and revenue that missed market expectations.

“Atlassian shares, which are listed on the US Nasdaq, dropped by as much as 25 per cent after that market closed on Friday morning (AEDT), and were last 22.6 per cent to $US134.73, suggesting a loss of nearly $US10bn from the company’s valuation.”

Atlassian’s share price is down 71% over the past year that has to hurt, even for a billionaire!

-Peter Switzer – Switzer Daily

Atlassian (TEAM)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances