The rush of new hybrid issues continues, with Origin Energy being the latest to announce an offer with a headline grabbing interest rate of around 8.7%. As we have noted in previous issues of the Switzer Super Report, there are more hybrid issues to come – although with Christmas fast approaching, this may be the last before February.

Origin is a leading integrated energy company. It supplies gas and other fuels to wholesale and retail customers, generates electrical power and it is also the largest energy retailer in Australia. On a market capitalisation basis, it ranks 15th on the ASX at around $15.6 billion.

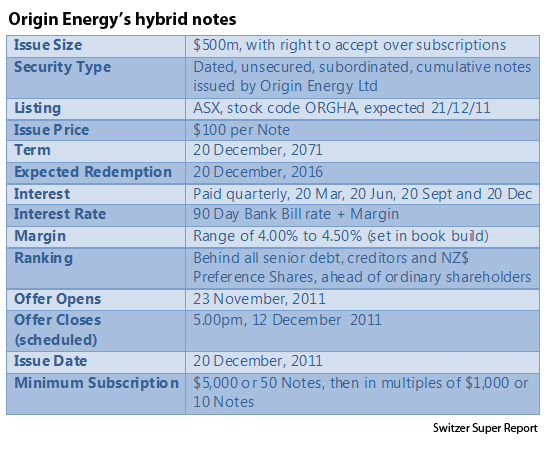

Origin is seeking to raise $500 million through the issue of ‘Origin Energy Notes’ and will use the money in part to fund its contribution to the Australian Pacific LNG Project. Further, these notes will be classified as ‘equity credit’ by the Ratings Agencies, which will support Origin in maintaining its corporate credit rating.

The Notes will pay interest at a rate of between 4% and 4.5% above the 90-day bank bill rate. The institutional book-build on Tuesday will set the final margin. At the lower end of 4%, this implies an interest rate of around 8.7% for the first quarter. At the higher end of 4.5%, the interest rate would be 9.2%. On paper at least, this looks pretty attractive.

Details of the issue are as follows:

Origin Energy as a corporate entity is rated BBB+ by Standard & Poor’s, and Baa1 by Moodys. This is classified as ‘investment grade’, but well down on the rating achieved by Woolworths, whose recent hybrid issue was priced at a margin of 3.25% over the 90-day bank bill rate. In overseas markets, some other note issues by Origin are effectively being priced by the market at a margin of around 7%. That said, retail investors can’t access these wholesale issues.

Origin Energy as a corporate entity is rated BBB+ by Standard & Poor’s, and Baa1 by Moodys. This is classified as ‘investment grade’, but well down on the rating achieved by Woolworths, whose recent hybrid issue was priced at a margin of 3.25% over the 90-day bank bill rate. In overseas markets, some other note issues by Origin are effectively being priced by the market at a margin of around 7%. That said, retail investors can’t access these wholesale issues.

Origin’s diversified portfolio of energy businesses and generally sound financial ratios should provide comfort to investors. The company’s interest coverage ratio (which is its ability to cover its interest payments) at 30 June was 6.6 times, and the adjusted gearing ratio was 23.9%.

An important feature of these Notes is that Origin Energy must defer payment of all interest if its corporate credit rating falls below ‘investment grade’. If this happens, Origin can only resume paying interest if it regains its investment-grade rating, or assuming it has the capacity to pay, after five years have elapsed.

Non investment grade (or junk status) under the Standard and Poor’s methodology is a rating of BB+ or lower. I should point out that this is three notches below Origin’s current corporate credit rating of BBB-.

Further, investors can probably take some comfort from Origin’s statement in the prospectus that if “Origin’s financial profile materially deteriorates and it believes one of its corporate credit ratings risks being below investment grade, Origin intends to take measures to avoid this, including asset sales, further equity issuance, discontinuation of certain businesses, suspension or ordinary dividends, etc.”.

So, where does this issue fit?

While definitely being in the higher risk category, it is pretty hard for retail investors and self managed super funds (SMSFs) to find comparable investment margins. I think this issue will be swallowed up. However, I caution that there are more issues to come, so keep some powder dry. Given the risk profile of these notes, they should be part, but not a major component, of a diversified portfolio of fixed income securities. The old adage “don’t put all your eggs in the one basket” applies.

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.