Retirees over the age of 60 can receive their superannuation benefits tax free, either as a lump sum or as an income stream. However, should the individual meet a condition of release and withdraw their benefits before 60, there could be tax consequences.

Paying a benefit to a non-tax dependant upon an individual’s death may also have tax implications. With these factors in mind, it is beneficial to ensure that any tax-free component of your super is maximised. An effective way to achieve this is by employing a re-contribution strategy. Here’s how to do it.

How re-contributions work

A re-contribution strategy, like Transition to Retirement, requires the individual to withdraw benefits from their super (provided they have met a condition of release) and re-contribute those amounts back into their super fund as non-concessional contributions, subject to the contribution caps.

In order to understand how a re-contribution strategy might be effective, it is important to identify the taxable and tax-free components of your super. The super laws define the taxable component of a superannuation interest to be equal to the value of the total interest less the tax-free component. Therefore by enlarging your tax-free component, you can reduce your taxable component.

The tax-free component consists of a crystallised segment and a contributions segment. For the majority of superannuation interests, the crystallised segment was calculated and set at 1 July 2007 and will remain unchanged. (Note: where the individual was under age 60 with an existing income stream at 1 July 2007, the crystallised segment will be triggered by specified events in accordance with section 307-125 of the Income Tax (Transitional Provisions) Act 1997). Therefore, in order to maximise a tax-free component, an individual can increase the contributions segment by increasing their non-concessional contributions.

Example

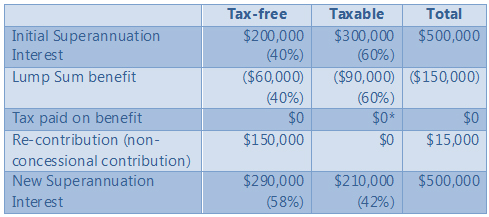

Sam is 57 in 2011-12, retired and would like to start a pension. Currently, his super balance is $500,000. If he were to start a pension today, his tax-free component would be $200,000 and his taxable component would be $300,000.

Instead, he withdraws a lump sum of $150,000, being $60,000 tax-free and $90,000 taxable – the proportion being the same as the components in the superannuation interest. The tax-free component is tax-free, but the taxable component for super lump sums will need to be included in his personal income tax return as part of his assessable income.

However, as he is aged between 55 and 59 and the taxable component of $60,000 is below the low rate cap (currently $165,000), he will receive a tax offset to ensure that he pays no tax (or Medicare levy) on this amount.

Sam then re-contributes the full $150,000 back into his super fund as a non-concessional contribution. As he is under the age of 65, the non-concessional cap is $150,000 and he does not need to meet a work test in order to contribute.

The re-contribution strategy:

* The net rate of tax is 0% on any amount up to the low-rate cap for super lump sum benefits received by individuals aged between age 55 and 60.

Sam’s super balance remains at $500,000, however he has now increased his tax-free component. The re-contribution now forms part of his tax-free component, thereby increasing it from $200,000 originally to $290,000. The taxable component has decreased from $300,000 to $210,000.

If Sam now decides to start a pension, he will have reduced the taxable component, which is assessable at his marginal tax rate less a 15% tax offset.

Further, if he dies and a death benefit is paid to non-tax dependants, they will be subject to tax only on the taxable component. By implementing the re-contribution strategy, he will have reduced the taxable component and thus the tax payable.

Think of these factors first

Importantly, the following issues should be considered before undertaking a re-contribution strategy:

- You must meet a condition of release to withdraw benefits.

- Ensure you are eligible to re-contribute the money back into the super fund.

Restrictions include individuals aged between 65 and 74 who must meet the work test before contributing. An individual meets the work test if they have been gainfully employed for at least 40 hours in a period of not more than 30 consecutive days in the financial year. No contributions can be accepted if the individual is aged 75 and above with the exception of mandated employer contributions, such as industrial awards. Currently employer super guarantee obligations cease when the employee reaches age 70, but the government has proposed the abolition of the age limit from 1 July 2013. This legislation is currently pending.

- Watch out for contribution caps.

Ensure the re-contribution is below the non-concessional cap to avoid excess contributions tax. For those aged 65 and over, the non-concessional cap is $150,000 for 2011-12. For those aged below 65 at any time during 2011-12, the non-concessional cap is $150,000 and the ‘bring forward’ rule can also be used. This effectively enables the individual to bring forward two years’ worth of non-concessional contributions, with a maximum of $450,000 of non-concessional contributions for the income year, without exceeding the cap and triggering excess contributions tax. However if maximum contributions are brought forward to the current financial year, no further non-concessional contributions will be permitted in the following two financial years.

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.