The dictionary may be your first port of call when identifying the meaning of words, but this could lead you astray when defining a ‘dependant’ when it comes to super.

This is because the dictionary, the Australian Tax Office (ATO) and the super laws each have their own take on who is and isn’t a dependant. But why does this definition matter?

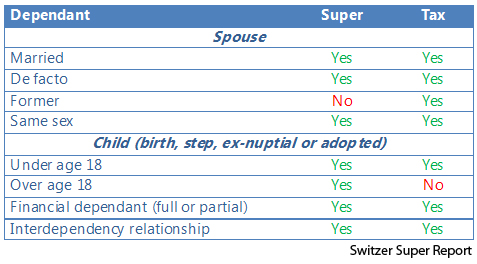

The definition of ‘dependant’ becomes highly relevant when a member of your self-managed super fund (SMSF) dies and a super death benefit is paid; not only does the definition determine who gets paid, but also how the benefit is taxed in the hands of a beneficiary.

Super dependants

This definition of ‘dependant’ in the Superannuation Industry Supervision (SIS) Act determines who can receive a super death benefit. This definition includes the spouse and any child of the person, and from 1 July 2004, any person with whom the person has an ‘interdependency relationship’ with. The inclusive definition means that a dependant under common law principles (generally a person who is financially dependent on the deceased) is also covered.

Tax dependants

The Income Tax Assessment Act (ITAA) 1997 contains the definition of ‘death benefits dependant’, which is used for the purposes of the taxation of super death benefits once paid, as a dependant or non-dependant.

Spouse

SpouseA spouse is a dependant regardless of whether the spouse was financially dependent on the deceased. A spouse includes to whom, at the time of death, the deceased was married to or with whom they were in a de facto relationship with or in a relationship that was registered under a law of a State or Territory (whether of the same sex or a different sex).

Important: Former spouses are dependants for tax purposes only – not for super.

Child

This includes any person, regardless of age, who at the member’s death was the member’s natural, step, adopted, ex-nuptial or current spouse’s child, including a child who was born through artificial conception procedures or under surrogacy arrangements with the member’s current spouse

Important: A child for tax purposes does not include a child age 18 or over.

Financial dependant and interdependency relationships have the following definitions for the purposes of both a super and tax dependant:

Financial dependant

A person who was financially dependent on the member at the time of the member’s death is considered a dependant. This means that the person could have been either wholly or partially financially dependent on the member to maintain their normal standard of living.

It is the trustee’s responsibility to decide whether a person was financially dependent on the member at the time of death.

Interdependency relationship

A dependant includes a person who was in an interdependency relationship with the deceased at the time of death. A person will have had an interdependency relationship with the deceased if they had a close personal relationship, they lived together, and one or each of them provided financial support, domestic support and personal care for the other at the time of the member’s death.

Examples include adult children who lived with elderly parents to care for them, or any person who resided with and significantly cared for the member just before the member’s death, that would be more substantial than that from a mere friend or flatmate.

If a person had a close personal relationship with the member, but did not satisfy the other criteria due to either person having had a physical, intellectual or psychiatric disability, or they are temporarily living apart due to one or both temporarily working overseas or in gaol, an interdependency relationship will still prevail.

Other circumstances taken into account include duration of the relationship, care and support of children, degree of commitment to a shared life and emotional support.

Importantly, interdependency relationships may have existed whether or not the person and the member were related. However, this is not the case if the care and support is provided by a person under an employment contract, contract for services or through another organisation.

Next step

Once a beneficiary is identified as a super dependant, the form and taxation of the super death benefit can then be determined. Understanding the different definitions of dependants is imperative in understanding how the super and tax acts apply to super death benefits. The final outcomes all depend on the dependants!

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.