In addition to the well-known taxation benefits on offer, investments held within a self-managed superannuation fund (SMSF) can also provide substantial Centrelink advantages – particularly to married couples.

This is significant because a person’s superannuation is not counted by Centrelink while that person is below their Age-Pension age. And it is this non-assessment that provides a number of opportunities for people who are seeking to receive Centrelink benefits – or to increase their entitlements in retirement.

Passing the asset test

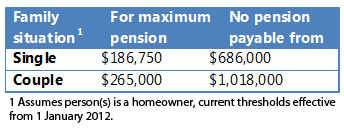

A look at the current Centrelink asset-test thresholds, which determine the level of assets allowed when calculating a pension entitlement, tells us that some level of Age pension may still be available for couples with assets up to $1,018,000.

While this might sound like a very generous level, the summary table below shows that there is quite a big difference between what you’re allowed to earn to receive a maximum pension entitlement and no pension at all – with a sliding scale operating in between.

Income test for receiving the Age Pensions

Understanding these thresholds is critical as they form a significant part of Centrelink’s assessment when determining how much support (if any) will be available.

Understanding these thresholds is critical as they form a significant part of Centrelink’s assessment when determining how much support (if any) will be available.

It should also be noted that the “For maximum pension” column is the only column relevant to people who are under Age-Pension age and looking to qualify for an allowance – such as the Newstart Allowance – because assets above this threshold will result in no payment eligibility at all.

So, when looking for SMSF opportunities to maximise retirement benefits, recent Australian Tax Office statistics indicate that around 70% of all SMSFs are made up of two members – typically husband and wife – creating a near-perfect combination for Centrelink planning.

Example

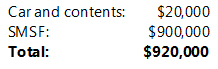

Consider Bill and Carol – Bill is age 65 while Carol is age 60. Excluding their family home, they have the following assets:

Of the assets held within their SMSF, a total of $690,000 represents Bill’s balance, while Carol has the remaining $210,000.

With Carol being under her Age Pension age of 65, her superannuation will not be counted under the asset test – however, Bill’s does. As a result, their combined assessable assets, including their car and contents, are a total of $710,000.

Under the asset test, this would result in a pension reduction of around $334 per fortnight for Bill. Further, Carol would not be eligible for any benefits for at least five years as she is under Age-Pension age and their combined assets automatically make her ineligible for an allowance.

How to make it work

Bill and Carol can improve their financial situation by transferring $450,000 from Bill’s super over to Carol, causing their combined assessable assets to fall to $260,000. As a result, Bill’s Age pension entitlement under the asset test would increase by around $334 a fortnight (or $8,684 a year), while Carol would potentially become eligible for an allowance of up to $439.40 (or $11,424.40 a year).

This represents a potential increase of over $20,000 a year for the next five years!

Of course, Bill and Carol will also need to consider the income test as Bill’s superannuation assets will be subject to deeming as a financial investment. However, this could be easily managed by converting his remaining account balance into a pension account.

Note: Once Carol reaches her Age-Pension age of 65, all of their super assets will become assessable once more.

What if Bill and Carol’s assets had been invested outside super?

If Bill and Carol had instead built up their investment assets outside of super – say through shares and term deposits – transferring these assets into their SMSF could help them achieve a similar outcome to the one outlined above.

How to make a transfer

In order to transfer super assets from Bill to Carol, Bill would essentially need to withdraw his super tax-free and re-contribute it into his SMSF as a spouse contribution.

Of course, as this involves making a super contribution, contribution cap considerations need to be carefully considered. You can read more about these in Making DIY super contributions.

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.

Also in the Switzer Super Report

- Peter Switzer: Dr Doom turns to Dr BOOM!

- Charlie Aitken: Australian banks are not what they used to be

- JP Goldman: How sector tilts can help you beat the index