Small business owners have potential concessions available to them to reduce a capital gain when they sell their business or certain assets. These are aptly called capital gains tax (CGT) small business concessions.

In certain circumstances, these concessions allow or sometimes require the business owner to contribute the proceeds of the sale to super, subject to certain conditions.

As the CGT small business concession tax rules are complex, here I’ll focus on its interaction with super.

What’s first?

There are two basic conditions that you must meet in order to qualify for CGT small business concessions.

1. (a) The business is a Small Business Entity, with an annual turnover of less than $2 million for the income year; or

(b) The maximum net asset value of the business doesn’t exceed $6 million; and

2. The business owner, affiliate or related entity uses the asset or holds it ready for use in the course of carrying on a business.

Further conditions apply if the asset is a share in a company or interest in a trust.

The concessions

Once these conditions are satisfied, the business owners can potentially access the following concessions:

15-year exemption

This permits the entire capital gain to be disregarded for tax purposes on assets that have been owned for 15 years. However, the business owner must be 55 years or over and retiring, or they have been permanently incapacitated. This exemption takes priority over the other concessions and the CGT discount. If it applies, the capital gain is entirely disregarded so there is no need for other concessions.

Small business 50% reduction

This reduces the capital gain on an active asset by 50%. Unlike the other concessions, this applies automatically if the basic conditions are satisfied, unless it’s chosen not to apply.

Small business retirement exemption

This exempts up to a lifetime limit of $500,000 of the capital gain. Despite the wording, there is no requirement to retire, but if the business owner is under 55, the exempt amount is to be paid into a complying super fund.

Small business rollover

This defers the capital gain on the sale of an active asset where the proceeds are used to purchase a replacement asset.

These concessions may be used in isolation or combined subject to age restrictions and lifetime limits, which refers to any previous use of the concession.

Also, if applicable, the general individual 50% discount for assets held for 12 months or more must be applied before the small business CGT concessions two and three above.

Contributing the proceeds to super

If a business owner qualifies for these concessions, they may contribute the sale proceeds to super subject to the lifetime CGT cap. For 2012/13, the cap amount is $1.255 million. Note that this is in addition to the concessional and non-concessional cap.

Further, the business owner must comply with the work test if they are between 65 and 75. From age 75, no super contributions are permitted.

Maximising super contributions

Whilst there is a choice to use the concessions in combination, a business owner might choose not to claim a certain concession in order to maximise the amount contributed to super. This is illustrated in the following example:

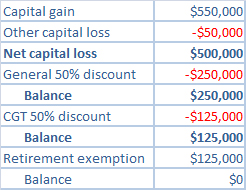

A 58-year-old small business owner sells her business that she has owned for the past five years and makes a gain of $550,000 and a separate capital loss of $50,000. She qualifies for the CGT small business concessions. Since she is not retiring and hasn’t owned the business for 15 years, she can’t use the 15-year exemption.

The gain has been reduced to $0, and she can contribute $125,000 into super under the CGT cap.

The gain has been reduced to $0, and she can contribute $125,000 into super under the CGT cap.

The lifetime cap is reduced by $125,000 and it doesn’t affect her concessional or non-concessional caps. The amount exempt under the CGT 50% discount may also be contributed to super, but it’s not counted towards the small business CGT cap. Instead it will be counted towards the general contributions caps.

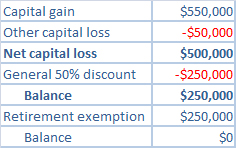

An alternative would be not to claim the CGT 50% discount.

The gain has still been reduced to $0, however she can contribute $250,000 into super under the small business CGT cap. This way she contributes more to super without affecting her concessional or non-concessional caps.

The gain has still been reduced to $0, however she can contribute $250,000 into super under the small business CGT cap. This way she contributes more to super without affecting her concessional or non-concessional caps.

Accessing the ability to disregard gains and maximise super contributions is a valuable tool for business owners, and ensuring the business qualifies for the concessions is the first important step. However, due to its complexity, it’s important to consult an adviser in order to get the most out of the small business CGT concessions.

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Anyone should consider the appropriateness of the information in regards to their circumstances.