The recent changes to the Reserve Bank of Australia’s (RBA) official cash rate, while good news for home owners and those holding debts, has also led to a relatively un-discussed negative for pensioners. The deeming rates as per Centrelink have not changed in line with the official cash rate, meaning as inflation increases the cost of living for individuals, the deposit rates on cash have fallen, leaving pensioners in a worse off position.

What is deeming?

Deeming is a simple set of social security rules that are used to assess income from financial assets. Under the pension income test and allowance income test, any income you get from financial investments is assessed under these rules.

Under these rules, Centrelink assumes financial assets are earning a certain amount of income, regardless of the income they actually earn.

The current rates

Currently a deeming rate of 3% applies to the first:

- $45,400 of a single customer’s total financial investments

- $75,600 of a pensioner couple’s total financial investments

- $37,800 of total financial investments for each member of an allowee couple.

A deeming rate of 4.5% then applies to financial investments above these amounts. The thresholds at which the higher deeming rate begins to apply are indexed in line with the CPI in July each year.

Deemed income is added to a recipient’s assessable income from all other sources, and the total amount is then used to calculate the rate of income support payment under the income test.

How deeming works?

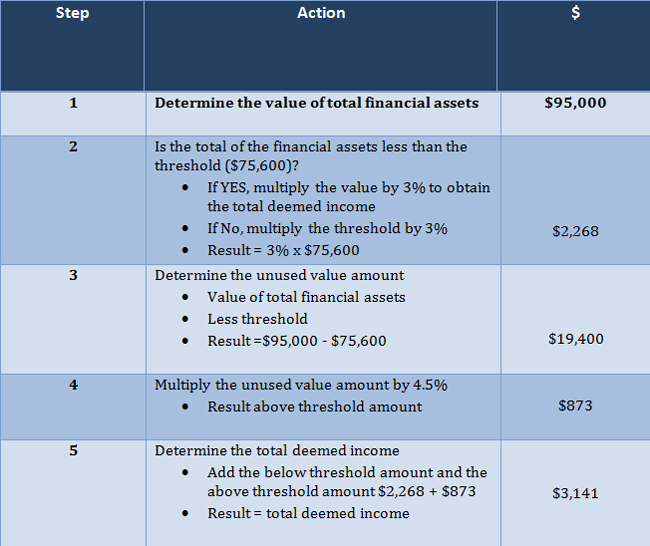

Jack and Jill are both age pension recipients, with a combined total of $95,000 in financial investments.

Calculation

The table below shows the deemed income calculation.

How deemed income is used

How deemed income is used

The total deemed income of $3,141, is added to any income Jack and Jill have from other sources to calculate how much they can be paid under the income test.

Actual income received from Jack and Jill’s total financial assets, if deposited into a cash management account with a 3% annual rate of return, is only $2,850. Jack and Jill are therefore worse off under Centrelink’s current deeming rate, as the actual income received is less than the deemed income.

Can the lack of action by the government to review the current deeming rates be seen as a continuous and much needed cash grab, and, if it is, what strategies can be put in place?

One strategy may be to put as much as you can in superannuation and start an income stream, which may be more beneficial as it provides a discounted amount of income being assessed.

The next RBA board meeting is on 5 February 2013, which may add more pressure on the government to review the deeming rates, if the RBA cash rate is cut again. A cut to the deeming rate would give an increased pension, which will soften the blow for retirees.

It is recommended that specific advice be sought regarding your level of income and assets and the potential impact on any social security entitlements. It is important to notify Centrelink of any changes in personal circumstances, as this may have an impact on the level of benefits you are in receipt of.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.