Most avid property investors are familiar with the Government’s Defence Housing Authority Scheme, which offers owners guaranteed rental for 10 years. A lesser-known but attractive Government scheme is the National Rental Affordability Scheme (NRAS), which offers investors a tax-free incentive of $9,524 per annum for 10 years on selected qualifying homes. With this incentive, investors should be able to positively gear a property and obtain a better income return than a property outside the scheme.

How does NRAS work?

Let’s start with how the scheme works. NRAS is an initiative of the Commonwealth Government to address the shortage of affordable rental housing. It aims to stimulate the private sector (including community housing associations) to build 50,000 high quality homes and apartments, which are in turn rented out to low and moderate income households at a rate that is at least 20% below prevailing market rates. Investors are ‘compensated’ for the below-market rate through the payment of an indexed, tax-free incentive for 10 years, which in 2011/12 is $9,524.

Major commercial developers and community housing associations tender to build these affordable rental properties. Tenders are awarded by the Government on the basis of strict criteria, which includes location, proximity to infrastructure, amenity, ability to complete and obviously the demand for affordable housing in that area. The new properties are then sold to investors (institutional and private), including self managed super funds. Sometimes the properties are sold ‘off the plan’.

More than 1.5 million Australian households are eligible to rent NRAS properties. Tenants tend to be key workers such as childcare workers, nurses, police officers, firefighters and paramedics. Tenants must meet income tests, which are quite high. For example, a couple with three children could earn a gross income of $104,913 per annum and still qualify to rent an NRAS property. The tenants are of course paying rent that is at least 20% below the market rate – on many properties it is 25%.

Why invest in NRAS?

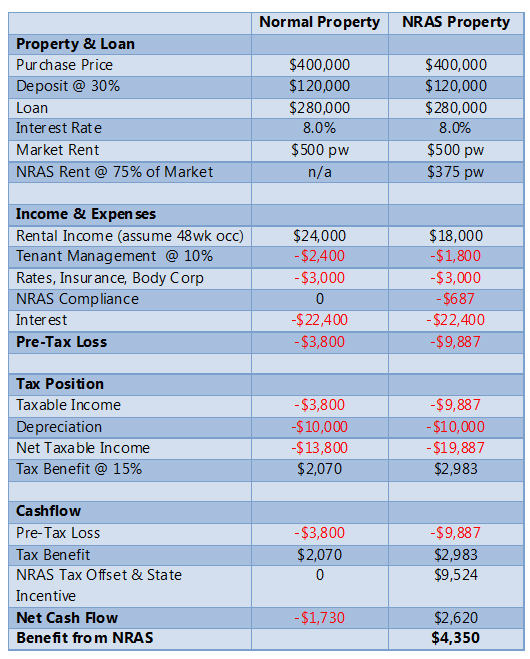

For private investors, the main attraction (notwithstanding the reduced rent) is the higher income return. As the table below shows, an SMSF investing in an NRAS property valued at $400,000 and geared to 70% would be $4,350 per annum better off than investing in a normal property – and effectively, positively geared.

According to the Queensland Affordable Housing Corporation – a nationally operating not-for-profit association that works with developers and investors and is one of the largest players in this market – two other advantages are improved occupancy rates and the tenants are ‘incentivised’ to maintain the properties.

According to the Queensland Affordable Housing Corporation – a nationally operating not-for-profit association that works with developers and investors and is one of the largest players in this market – two other advantages are improved occupancy rates and the tenants are ‘incentivised’ to maintain the properties.

Leases of one, three or even five years are not uncommon and due to the demand for these properties, with (in their case) rents at least 25% below market, the ‘bad tenant’ phenomena is very rare.

What are the risks?

Well, the old property adage is “location, location, location”. As these homes are designed for less affluent households, they will tend to be located in regional areas and the less affluent suburbs of major cities. Over the 10 years, better capital gains may be available in other locations.

That is not to say that an NRAS home won’t deliver a really good capital gain. Further, NRAS homes and apartments are being built in inner city areas and affluent suburbs. They are not built as part of a public housing estate – in fact, most NRAS properties are part of a major development, with NRAS homes in a minority compared to non-NRAS homes.

The other risk is liquidity. While NRAS homes can be sold without penalty in the 10-year period, they can only be sold to another investor who undertakes to comply with the NRAS obligations (and compliance). At the end of 10 years, the property reverts to the full control of the investor, with no ongoing obligations to the Australian Government.

With any investment, I always get worried when a quick ‘google’ reveals several parties offering “free investor seminars”. If you are interested in learning more about NRAS, I would start with the government’s website and then once you’re familiar with the program, by all means, go to a seminar or two.

Shop around, do your homework and speak to the local community housing association. If you need finance, most of the banks are coming up to speed with this market and developing ‘packaged solutions’ for SMSFs.

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.