With the recent fall in term deposit rates, self managed super trustees may be tempted to look around for some ‘alternative’ higher yield income investments. One that caught my eye last week was an advertisement in the Australian Financial Review from a company called Australian Public Trustees Limited. The ad promoted an eye-catching rate of up to 8.75% on a five-year term investment in their income fund, so I decided to dig a little deeper.

So, who is Australian Public Trustees, and what is their income fund? Well, let’s start with who they’re not. Australian Public Trustees is NOT, in their own words, a “Statutory or Licensed Trustee Company, or the Public Trustee of the Commonwealth or any State or Territory, or related to a Government Authority of any kind”.

Australian Public Trustees is part of Stanfield Funds Management Ltd, an ASX-listed company with a market capitalisation of about $4 million (ASX:SFN). Australian Public Trustees is the fund administrator of the Australian Public Trustees Income Fund, an open-ended unit trust.

The Fund invests in mortgages secured against public and social infrastructure, government-leased properties, and commercial and residential property. It has an interesting structure with two classes of units: Term Investment Units and Ordinary Units. Stanfield Funds Management holds all the Ordinary Units, with the public being invited to invest in the Term Investment Units, which rank ahead of the ordinary units in any winding up of the Fund.

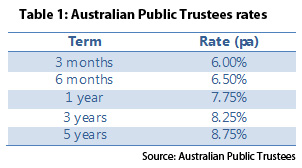

An investment in Term Investment Units offers the investor the potential of a high-income return, paid monthly to your nominated bank account. The rates being offered are in Table 1:

So, why have I said this is an investment to avoid?

So, why have I said this is an investment to avoid?

Simply, it’s not a high enough return to justify the risk. If you want to take some risk, you can do better elsewhere.

What is the risk?

Well, firstly it’s a tiny fund. According to an ASX announcement from Stanfield, it is a little more than $3 million. While the small size of the fund doesn’t in itself necessarily mean higher risk, the nature of the mortgage investments the fund invests in means that it is currently exposed to a handful of individual assets.

More importantly, the major risk is around liquidity. While the fund has stated that it will hold a targeted minimum of 10% of its asset portfolio in cash for liquidity purposes, the assets it is currently investing in are relatively illiquid. There is a market for mortgage investments, however, it’s not anywhere as liquid as the stock market or bond market. If several term investment units mature around the same time and investors want their money back, the 10% in the liquidity buffer may not be enough to go around.

Finally, the supplementary product disclosure statement dated 19 September 2011 has this interesting statement: “The Directors have elected not to publish the Audited Financial Statements (of the Responsible Entity and the Fund) on the website of Australian Public Trustees at this time”. Say no more.

So what are some alternatives for the yield-hungry SMSF? Two fixed income investments that can be bought or sold on the ASX are Heritage Notes and Healthscope Notes. While at different parts of the risk curve, they do highlight the potential returns available.

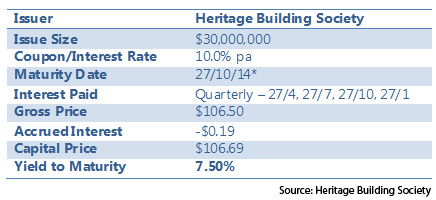

Heritage Notes (ASX:HBSHA) are subordinated, unsecured debt securities of Heritage Building Society, one of the larger building societies in Australia. Initially rated BBB- from Standard & Poor’s, details of these notes are:

The Heritage Notes don’t mature until 25 October 2019. However, a penal rate of interest applies if the notes are not redeemed in October 2014 and are hence priced on that basis.

The Heritage Notes don’t mature until 25 October 2019. However, a penal rate of interest applies if the notes are not redeemed in October 2014 and are hence priced on that basis.

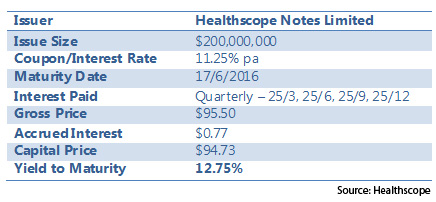

Healthscope Notes Limited (ASX:HLNG) were issued in November 2010. The Company is part of the Healthscope Group, a leading Australian private healthcare services provider (hospitals and pathology services).

The notes are subordinated to the senior debt of the Group. As the prospectus prominently said, “The Healthscope Group has a substantial amount of debt” – more than $1.5 billion as at 30/6/11 – so these notes are close to the ‘junk’ category and hence the high yield. The company is in compliance with all its banking covenants. Details are:

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.