It’s been a slow train coming but most of you know I’ve been telling you that when inflation falls, stocks will surge and that’s what we saw on Thursday in the US and Friday here. And happily it has happened in the December quarter as I predicted, but now we need another good inflation reading on December 13. Boy, if that happens, the doubters who think this rally will need to be sold off, will have to jump on board and this could create the mother of all Santa Claus rallies!

Well, before the close, big tech companies in the US had a huge bounce back, with Amazon up 17%, Meta 12%, Alphabet 10%, Apple 10% and Microsoft also 10% higher since Thursday. That said, I’m cautiously positive and the caution comes from the unreliability of official statistics when it comes to one month. This means the market will be watching all inflation-predictive data between now and December 13, like the way a Labrador watches a sausage on a barbecue! The best news from that inflation reading came out of the bond market. This is what CNBC reported at the time: “Treasury yields plunged after the CPI report, with the 10-year Treasury yield falling more than 18 basis points to 3.946%, as traders bet the Federal Reserve would slow its aggressive tightening campaign that’s weighed on markets all year. The yield on the 2-year Treasury dropped more than 23 basis points to 4.395% (1 basis point equals 0.01%).” This is a good sign not only for interest rate worriers and tech stocks that get creamed as rates rise, but also companies that rely on debt and bond fund managers, who could get cooked if rates keep on rising too far and too fast. Provided the US avoids a recession, it could be a great year for balanced investors, who might be 60% in stocks and 40% in defensive assets. In case you missed it, in October, CNBC led with this headline: “This classic investment strategy is on track for its ‘worst year ever’—here’s what to do with your money.”

Basically, by holding 60% of your portfolio in stocks and 40% in bonds, the thinking goes that you get the best of both worlds — high growth potential from your riskier stocks and protection from your more conservative bonds. And advisers have stuck with this for decades, even centuries. And check this out from that piece: “From the start of 2022 through September 28, a 60/40 portfolio invested in line with benchmark U.S. stock and bond indexes shed 20%. Only two calendar years — both during the Great Depression — have been worse!” Hopefully, we’re seeing the best sneak preview so far of what might lie ahead in 2023, if and when inflation keeps falling. However, there are respected commentators and market experts, such as Art Cashin of UBS (who’s the oldest and longest-serving broker at the New York Stock Exchange), who says you can’t rule this out from being another bear market rally.

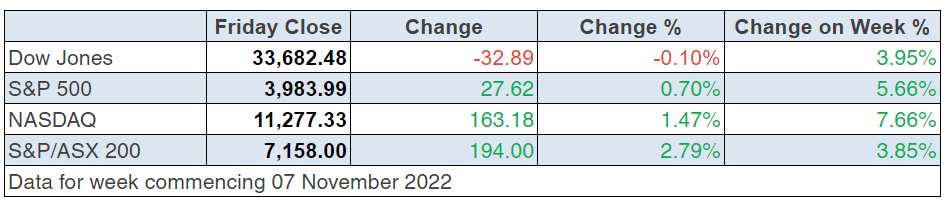

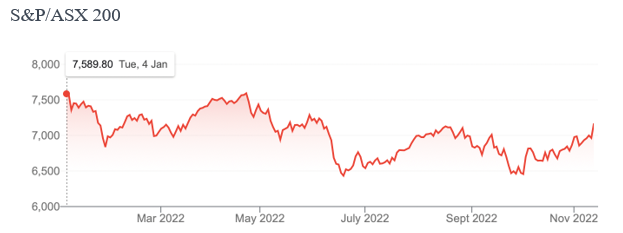

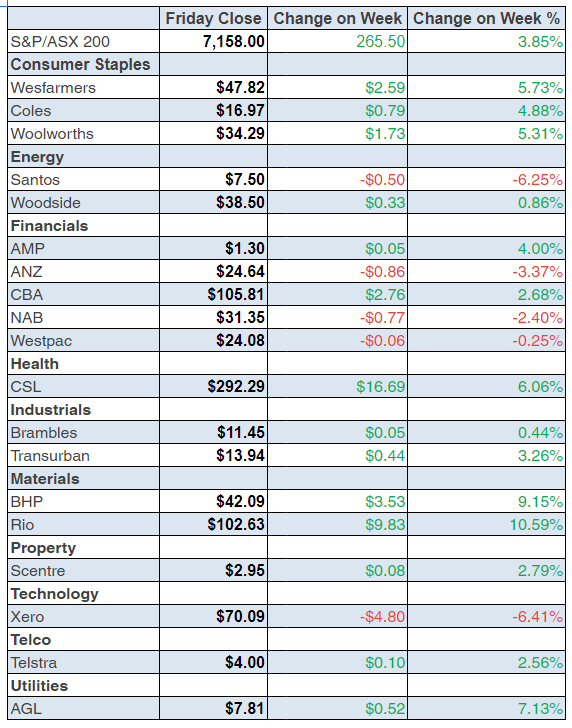

For the sake of objectivity, I’ll share Art’s view: “I still think we probably will go back and re-test the lows. Yesterday’s rally was borderline miraculous. … But, not to rain on the parade, you must remember that rallies in bear markets are short, sharp and die in low volume.” Doubters will take profit and short sellers will test this bounceback, but if December comes through with another CPI fall, we’ll be off to the races. Ultimately, data drops over the next month and what the Fed does in December 13-14, will determine the future of stock prices. To the local story, and that better-than-expected drop in inflation powered a big bounce, with the S&P/ASX 200 up 194 points (or 2.79%) on Friday alone, which meant a 265-point gain (or 3.85%) for the week, leaving the index at 7158 And this was also helped by Beijing officials calling for a more targeted approach to Covid restrictions, with the virus on the rise again.

I know it might have seemed unbelievable when I said we could end up in positive territory for the year (when we get to New Year’s Eve), but our market is now only down 5.69% for the year!

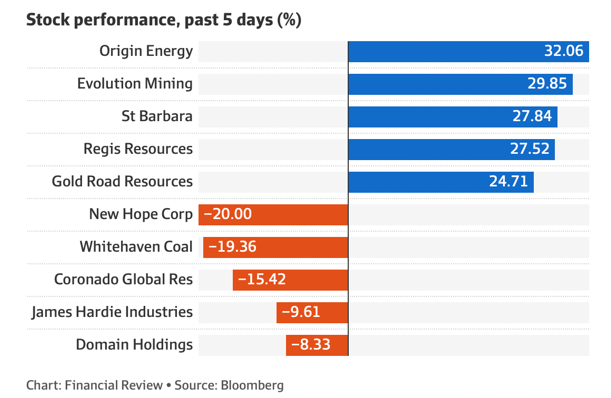

The thought that interest rate rises in the US, and therefore here too, helped interest-rate sensitive stocks and tech had a good day. Zip was up 18.4% to 74 cents, Megaport put on 13.57% to $6.11 and Audinate rose 7.87% to $8.50. And the chart below shows how Origin benefitted from the takeover offer this week, while gold glittered with the possible ending of US rate rises more in sight following that inflation story. As Investopedia says: “All else being equal, a stronger U.S. dollar tends to keep the price of gold lower and more controlled, while a weaker U.S. dollar is likely to drive the price of gold higher through increasing demand (because more gold can be purchased when the dollar is weaker).”

Meanwhile, profit-taking has gripped the coal companies’ stock prices but even though New Hope was down 20% for the week, it’s still up 122% year-to-date! Whitehaven is up 191% over 2022 but remember these stocks will be vulnerable to the ending of the Ukraine war.

What I liked

- The US Consumer Price Index (CPI) rose by 0.4% in October (survey: 0.6%). Annual growth eased from 8.2% to 7.7% (survey: 7.9%), its lowest level since January. The core CPI (excluding food and energy) rose by 0.3% in October (survey: 0.5%). That’s a ripper result and we want more ASAP.

- CommSec estimates that business turnover lifted 26.9% over the year to September.

- NAB business conditions eased from a 15-month high of 23.3 points to 21.9 in October, which is a good now sign and the survey generally reported lower cost pressures.

- The CommBank (CBA) Household Spending Intentions (HSI) Index rose by 0.9% in October but annual growth fell from 14.1% to 7.4%. That’s a decent but OK fall, which helps slow down inflation.

- The Reserve Bank (RBA) says it is watching consumer spending very closely as a guide to future movements on cash rates. At this stage, Commonwealth Bank Group economists expect just one more rate hike – a 25 basis point increase in December. That’s sensible.

- Out of the 216 STOXX 600 companies (that’s the European stock market index) nearly 60% of them have reported better-than-expected earnings, compared to a typical quarter where 53% beat analyst estimates, according to Refinitiv data.

What I didn’t like

- The weekly ANZ-Roy Morgan consumer confidence index fell by 1.5% to 78.7 (long-run average 112.2). The RBA must be careful.

- The Westpac-Melbourne Institute monthly index of consumer sentiment fell by 6.9% in November and nearly 40% of consumers (a record high) are looking to cut Christmas spending.

- NAB’s business confidence fell from 4.5 to 0.2 index points.

- The delay in deciding who won what in the US mid-term elections.

- News that cryptocurrency exchange Binance had walked away from a bailout deal to acquire FTX.

- In US economic data,the business optimism index eased from 92.1 to 91.3 in October (survey: 92). The economic optimism index fell from 41.6 to 40.4 in November (survey: 41.5).

A big Saturday dislike!

The US has ended daylight saving (summer) time and so now Wall Street closes at 8am Sydney time. Anything can happen in those last hours and I file my Saturday report at 7am! Ahead of the close, the Dow was struggling to rise but it’s not tech-heavy though it does have Apple and Microsoft. The S&P 500 was up strongly and so was the Nasdaq.

I’ll do my best to guess that often dramatic last hour, as I’ve done for nearly a decade, and so far, no one has complained — you’re such a decent bunch! I expect the S&P 500 and the NASDAQ to finish higher and the Dow could sneak into positive territory.

The week in review:

- In this week’s Switzer Report, I talk all about tech stocks and how to patiently profit off them: when rates stop rising, there’ll be an inevitable rotation out of the Dow-like stocks into growth. That’s when the patient who are hedged will be rewarded.

- Paul Rickard discusses how Westpac (WBC) has been a very high performing stock but has it railed too far? Since the start of October, Westpac had rallied almost 17% making it the best performing major bank over this period. So on the basis of the old axiom “buy the rumour, sell the fact”, it was no surprise to see it fall today by around 3% when it delivered an “as expected” full year financial result.

- Tony Featherstone likes using Listed Investment Companies (LIC) for yield. Tony discusses three LICs that suit yield-focused investors in this market.

- James Dunn is back with his series on little-known champions of the ASX’s micro-cap world. Here are two great examples of world-leading technology tapping into tailwinds.

- In our Hot Stock column this week, Michael Gable, Managing Director of Fairmont Equities, reveals his thoughts on AUB Group (AUB).

- In Buy, Hold, Sell – Brokers Say, there were 10 upgrades and 6 downgrades in the first edition and 7 upgrades and 3 downgrades in the second edition.

- And finally, In Paul’s (Rickard) Questions of the Week, Paul answers your queries on If any brokers changed their recommendation for Westpac? When do NAB and Westpac trade ‘ex-dividend’? When will the dividends be paid? If DRPs (dividend re-investment plans) are a good idea or investment? Why has Resmed (RMD) slipped a touch? Is this still a good growth stock?

Our videos of the week:

- Is it time to buy tech stocks? If so, what? XRO, ZIP, APN & more! | Switzer Investing (Monday)

- Has Albanese got super in his sights? + Crypto falls out of bed…again is this the end of bitcoin?! | Mad about Money

- Boom! Doom! Zoom! | 10 November 2022

- Rudi on the tech stocks he likes right now + the auctioneer on The Block explains the controversy | Switzer Investing (Thursday)

Top Stocks – how they fared:

The Week Ahead:

Food for thought: “The four most dangerous words in investing are: ‘this time it’s different.’” – Sir John Templeton

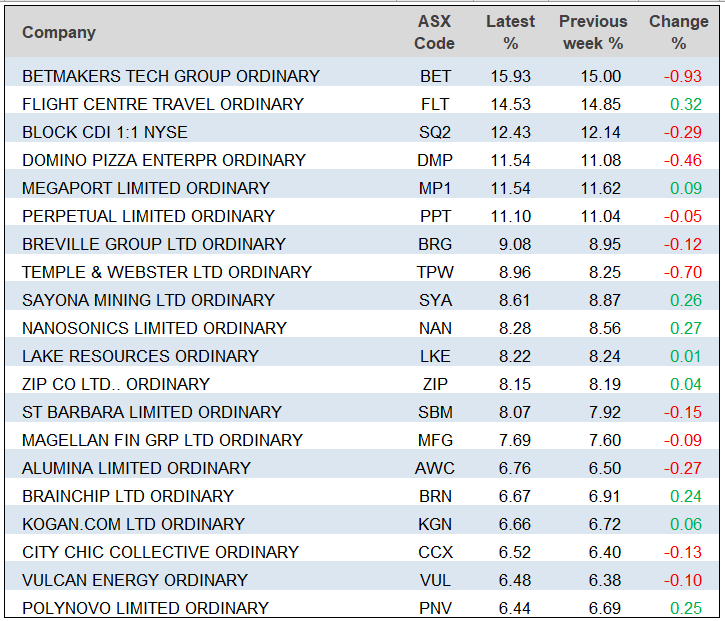

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

US elections, takeovers, cyber security, and bitcoin dominated the news this week as the bulls stuck a tentative toe into the market and nudged the S&P/ASX200 over 7000 on Wednesday, before falling back to a close yesterday at 6964.

The 0.5% downtick on Thursday of the index is an indicator we remain in bear territory. As the graph shows, over the past 12 months the index is down 6.19%, over six months it is up 0.33%, but over three months its down 1.51% and one month up 4.44%. – Damon Firth, nabtrade.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances