‘Crazy but believable’ must be the assessment of Wall Street’s reaction to a disappointing CPI number for the month of September. That inflation reading should have led to a fall in stock prices on Thursday, yet we saw a big rise. Then overnight the optimists tried to do it again. But this time there was “no cigar”, as the Yanks love to say.

To recap, the Consumer Price Index (CPI) rose by 0.4% in September against an economists’ survey guess of 0.2%. Inflation did fall on an annual basis from 8.3% to 8.2% but the survey tipped 8.1%. The core CPI, which excludes food and energy, spiked by 0.6% against expectations of a 0.4% rise and over the past year was up from 6.3% to 6.6%.

Then this happened: the Dow Jones Index rose by 828 points (or 2.8%) recovering from a 549 point drop earlier in the session. The S&P 500 index lifted 2.6% and the Nasdaq index gained 232 points (or 2.2%).

If I hadn’t been doing this stuff for decades, I would have had the normal person reaction of “what the f— happened?” However, nothing surprises me short term in the era of computer trading, AI and short-selling hedge funds.

That said, I doubted the Yanks on Wall Street could buy two days in a row after those inflation numbers, but they tried, with the Dow up 390 points earlier, but that couldn’t last.

But why was there buying on Thursday? Was there anything notable worth remembering to influence how you should play the market going forward?

I will look at that in more detail in my Monday piece, but here’s a glimpse of some of the thinking from Tina Teng, an analyst at CMC Markets, after the likes of the Nikkei Index in Japan surged 3.3% on Thursday. This was the biggest one-day move up in seven months.

The trigger for the U-turn on Friday from ‘buy the market to sell it’, according to experts surveyed by CNBC’s reporting teams, was worrying data.

“Stocks fell to session lows after a consumer survey from the University of Michigan showed inflation expectations were increasing, sentiment that the Federal Reserve is likely watching closely,” the reporters noted. “The tech-heavy Nasdaq led declines as growth companies are most sensitive to interest rate hikes”.

This coincided with bond yields going higher with the 10-year U.S. Treasury bond topping 4% for the second time in two days, which is never good for tech and growth stocks.

The important take-out from all this is something I’ve been warning about for months, and to steal a line from Bill Clinton, “It’s data, stupid.”

In a speech this week, the US president of the Chicago Federal Reserve Charles Evans said there was a strong consensus amongst Fed officials to lift the federal funds policy rate to 4.5% by March and then hold it there: “We’re headed for this four and a half percent-ish federal funds rate by March”, he said.

That was a stupid thing to say, unless he said it to scare the pants off Americans to help lower inflation, with the current Fed rate now only in the 3-3.25% range after three O.75% increases in a row, pushing borrowing costs to the highest since 2008!

A less scary comment for stock players came from the US Federal Reserve vice-chair Lael Brainard when she said that “the actual path (of rates) will be data dependent”.

And the course of the stock market will also be data dependent, but what we’ve seen over the past two weeks (recall the 5.5% rise of our stock market over two days last week) shows you how the market will rebound when this rate-rising cycle looks like it’s near its endpoint.

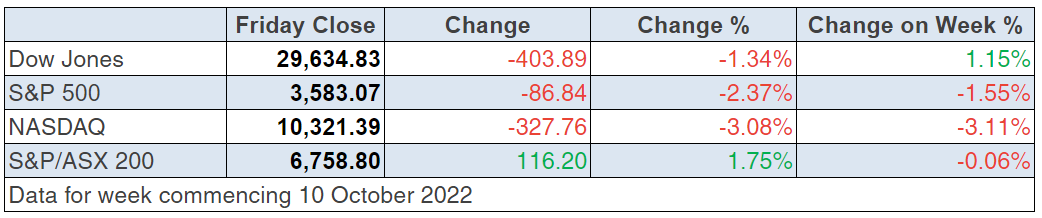

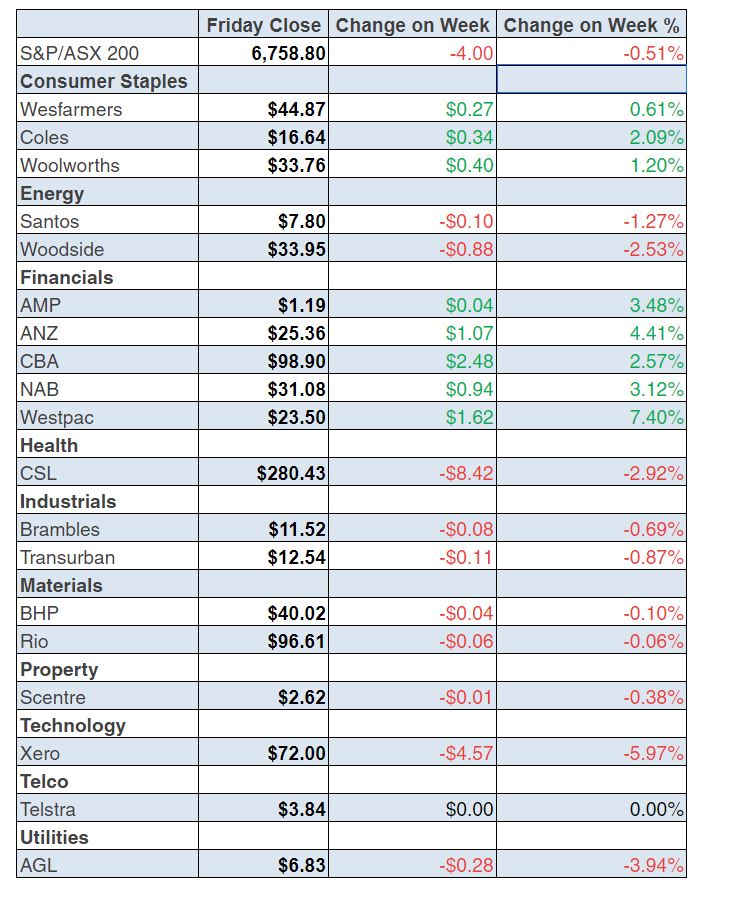

To the local story and stocks had a ‘follow the Wall St leader’ good day on Friday, with the S&P/ASX 200 up 116.2 points (or 1.75%) to be down only 0.06% for the week, finishing at 6758.80.

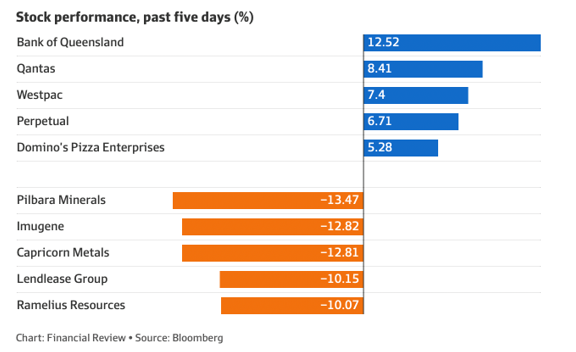

Here were the star and struggler performers for the week:

We all know the good Qantas story and it had a nice gain. So too did BOQ, with home loans up 8% and the market gave it a big tick. Rising interest rates and a low expectation about Australia going into recession must be good for the bottom lines of all banks.

What I liked

- In September, the CommSec index of luxury new vehicle sales hit a record high of 12,603. This is good recession-fighting news but isn’t great for inflation-beating goals of the RBA.

- The Reserve Bank Assistant Governor (Economic) Luci Ellis delivered a speech focussing on the fabled “neutral” cash rate – the rate that neither serves to boost economic activity nor serves as a brake. Ms Ellis identified the “nominal neutral cash rate” to be at least 2.5%. It’s now 2.6%.

- SEEK reported that job vacancies fell 5.2% in September but were up 15.5% on the year. This suggests a slowing economy with fewer job offerings, which is good for inflation.

- The Internet Vacancy Index from the National Skills Commission fell by 5.9% (the highest in 13 months) in September.

- NAB business conditions rose from 22 index points to a 15-month high of 25 in September. The survey reported an easing of cost pressures, which is good for inflation.

- No recession signs here, with nominal business turnover lifting in 12 of the 13 selected industries in August. CommSec calculates that business spending is up a record 28% on a year ago.

- The CommBank Household Spending Intentions Index declined by 0.5% in September, the first monthly decline since April this year. That’s good inflation news.

- According to minutes of the last Federal Reserve policy-makingcommittee “participants observed that it would be appropriate at some point to slow the pace of rate increases while assessing the cumulative effects of policy adjustments”.But also “many participants raised their assessment of the Fed funds path needed to achieve committee goals”.

- US Consumer inflation expectations eased from 5.7% to 5.4% in September.

What I didn’t like

- The US CPI number, but I liked the stock market response!

- UK bond problems out of the Liz Truss Government tax plan disaster. Overnight the PM changed her Chancellor of Exchequer, which is the Pom’s fancy name for Treasurer, and she U-turned on her tax cuts.

- NAB’s business confidence reading fell from 10 to 5 index points.

- The weekly ANZ-Roy Morgan consumer confidence index fell by 1.1% to 84.6 (long-run average 112.2).

- The Westpac-Melbourne Institute monthly index of consumer sentiment fell by 0.9% in October.

- The US Economic Optimism index fell from 44.7 to 41.6 in October (survey: 43). This is a worrying sign for a recession but good news for bringing down inflation.

- In US economic data,the Producer Price Index rose by 0.4% in September (survey: 0.2%).

- Russia launched its most widespread air strikes since the start of the Ukraine war, in what President Vladimir Putin called revenge for the explosion on the Crimea bridge. This is bad for inflation and recession fears globally.

I have like-confusion!

Usually, it’s easy to nominate data that’s good or bad for the stock market and the economy. For example, rising consumer confidence is good for economic growth and the stock market going higher but when you have two fears of rising inflation and rate rises that could cause a recession, you’re really hoping for a Goldilocks-like soft landing outcome, that “just right”.

We want lower inflation without a recession. That’s why it’s hard to work out what I like or dislike right now.

Over the week in the US, initial jobless claims rose by 9,000 to 228,000, which was more than expected. This is a tick for fighting inflation, but is it an early sign that a recession is brewing? And then there’s this question: Was this rise too small? That’s bad for anyone hoping for inflation to fall.

It’s a tough job looking for turnaround signs for stocks, but that’s my beat.

The week in review:

- Lately, a number of my clients have been indicating they want their portfolios to be more income-oriented, which I think is a great idea. This week in the Switzer Report, I discuss 3 big reliable income payers for you to consider if you are looking for income.

- While personal experience is playing a major part in Paul’s thinking on Qantas, it’s also supported by the metrics and the views of the major brokers. Paul (Rickard) recently just came back from London, flying both ways on Qantas. Here is Paul (Rickard’s) view on whether he thinks the company is set to soar or not.

- A volatile share market isn’t slowing Exchange Traded Fund (ETF) issuers. They keep launching ETFs that provide exposure to investment themes or offshore assets – and interest in index investing continues to grow. The ETF market on the ASX was worth about $127 billion at end the end of August 2022, ASX data shows. That’s up slightly on a year earlier, which is a fair effort in a falling market. Here are three ETFs that have caught Tony Featherstone’s eye this year.

- The mooted transition to renewable energy and electric vehicles (EVs), and the “Net Zero” plans of many countries, have driven investor fervour on the stock market for the producers of the materials required. James Dunn looks at the biggest ASX-listed graphite player, and four punts that investors who understand the risks might be prepared to make.

- In our HOT stock column this week, Raymond Chan, Head of Asian Desk at Morgans, says that his top pick is Telstra (TLS). Also, Michael Gable Managing Director of Fairmont Equities, reveals his thoughts on Westpac (WBC).

- In Buy, Hold, Sell — Brokers Say, there were 3 upgrades and 5 downgrades in the first edition and 6 upgrades and 6 downgrades in the second edition.

- And finally, in Questions of the Week, Paul (Rickard) answers your queries about whether there is still value in BOQ? Can a SMSF continue to operate if one of only two trustees dies or becomes incompetent? How will the Telstra restructure impact you as a shareholder? Will Telstra’s ASX code change?

Our videos of the week:

- 3 top stocks our expert likes & what we learnt from the market last week + a high-flying stock! | Switzer Investing (Monday)

- Premier of NSW Dominic Perrottet pushes for crucial stamp duty reform + 3 stocks Rudi would buy now! | Switzer Investing (Thursday)

- Are we on the brink of recession? + Should we panic about the shenanigans in the UK bond market? | Mad about Money

- Boom! Doom! Zoom! | 13 October 2022

- The truth about COVID vaccines | The Check Up

Top Stocks – how they fared:

The Week Ahead:

Food for thought:

“All you need for a lifetime of successful investing is a few big winners, and the pluses from those will overwhelm the minuses from the stocks that don’t work out.”

— Peter Lynch

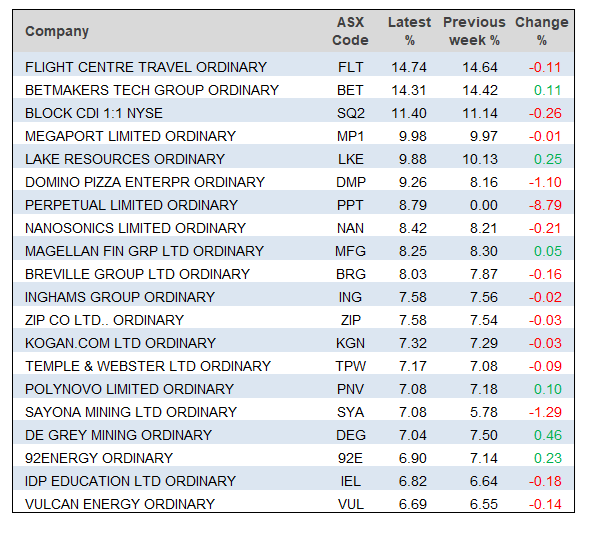

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

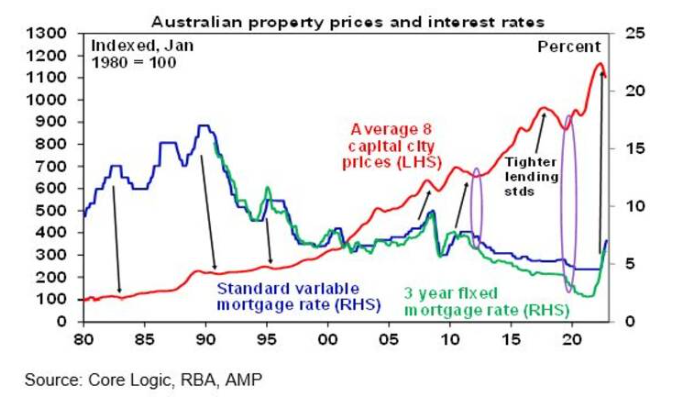

Core Logic data showed that home prices fell another 1.4% in September. National average prices are now down 4.8% from their high and have seen their fastest pace of decline over five months since the early 1980s. While the rate of monthly decline slowed a bit (including in Sydney and Melbourne), this likely reflects the market getting used to the initial shock of rate hikes, bargain hunters taking advantage of lower prices and vendors holding off selling. But with the full impact of rate hikes to date yet to be felt, interest rates still rising, and the economy set to weaken, it’s unlikely to presage an imminent bottoming in home prices.

Top 5 most clicked:

3 big reliable income payers – Peter Switzer

Is Qantas set to soar? – Paul Rickard

Buy, Hold, Sell – What the Brokers Say – Rudi Filapek-Vandyck

4 Speculative graphite stocks – James Dunn

Questions of the week – Paul Rickard –

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.