If you’re a shareholder in the listed company Contango Income Generator Limited (CIE) or considering becoming one, the board recently announced a proposal to adopt a new investment strategy for its investment portfolio, involving arguably one of the best fund managers in the world in WCM Investment Management (WCM).

The plan is to turn CIE into a global long-short vehicle that would invest in some of the world’s best international growth companies.

Fast growing companies not only can deliver solid capital gains, they can also produce the basis for a listed investment company (LIC) to pay income. One of the benefits of a LIC is that profits can be retained and distributed as dividends, meaning that income and growth are not mutually exclusive in the LIC structure.

The independent directors of CIE unanimously believe that the proposal will enhance shareholder returns and that this proposal is in the best interests of the Company and its shareholders in a post-COVID-19 environment, where interest rates will be lower for longer and where dividends are expected to be squeezed for some time.

Who is the proposed fund manager?

WCM is a world-class fund manager with an outstanding track record across multiple investment strategies. WCM currently manages in excess of A$85 billion¹ on behalf of institutional and retail investors around the world. WCM entered the Australian market in 2013 and manages approximately A$2.5 billion1 for Australian investors.

The proposed WCM Quality Global Growth Long Short Strategy has (since inception on 30 June 2014) generated a return of 23.5% per annum², outperforming its benchmark, the MSCI All Country World Index by an annualised 11.9%2 per annum.

The strategy will complement WCM Global Growth Limited (WQG), a successful large cap, long only LIC that was floated in June 2017. WQG’s investment portfolio has generated a return of 22.5% after fees³ since listing and the company is already rewarding shareholders with dividends that are now partially franked.

Why now?

The impact of the Coronavirus and the ensuing stock market crash resulted in an inability for CIE to declare a final dividend due to the lack of distributable profits at that time, lower dividends from companies that once were seen as consistent dividend payers, and the low levels of growth in the mid-cap sector. In the present environment, any alternate Australian equities fund manager is likely to face the same obstacles. Therefore, the independent directors of CIE believe WCM, and the companies in which they invest, are best placed to generate the long-term profits necessary to restore dividends. WCM’s investment record, which compares favourably with the likes of the highly regarded Magellan Financial Group’s fund performance, explains why the board is putting this option to its shareholders.

Alternative proposals

The board of CIE stated that no formal alternative proposals had been received when it announced the new WCM strategy. The board said that a number of other fund managers were considered as part of a manager selection process undertaken on behalf of the Company over a period of time. This included Wilson Asset Management (Wilson) however, CIE was advised on 16 June 2020 that Wilson was unable to engage with CIE due to capacity issues (this means he can’t manage any more money for investors). Although Wilson has now expressed an interest, his capacity constraints presumably remain an issue.

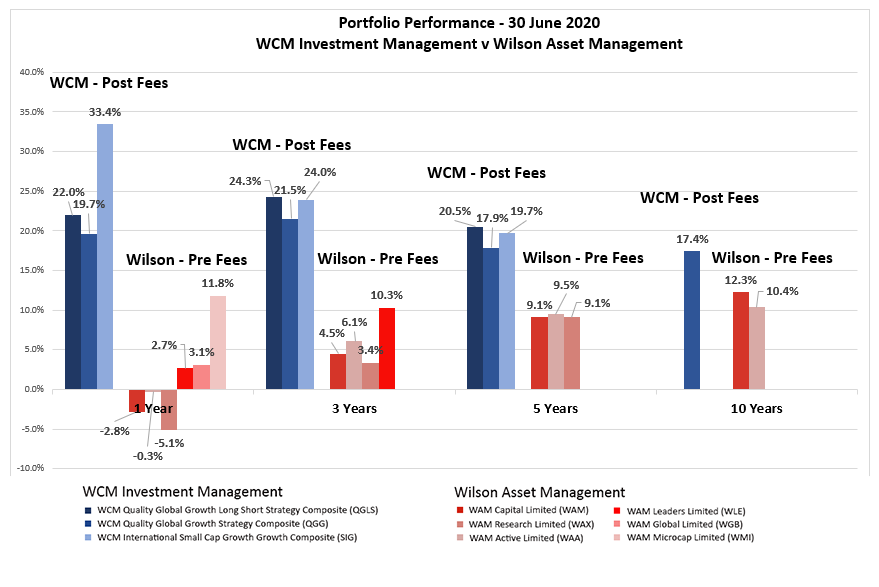

In considering Wilson as an alternative investment adviser, the board advised that they considered the relative investment performance of Wilson’s LICs (before fees) with that of WCM (after fees) over a wide range of investment time frames. The chart below demonstrates the significantly superior performance of WCM (over all strategies and time frames) compared with Wilson4:

Click here to enlarge the performance chart.

The performance figures for WCM in the previous chart are after fees, whereas for Wilson they are before fees because Wilson chooses not to disclose easily the performance of its LICs after fees. Generally, best practice governance for fund managers requires fully transparent fee disclosure. As you would expect, the industry believes after-fee performance is the only appropriate method of comparison of investment performance. Currently, why does a retail fund manager as well-known as Geoff Wilson not report his returns after fees?

Because of the heralded period of low dividends going forward, the source of better income from many strategies will be via capital growth. Those fund managers who can generate good growth by their better stock selection and state of the art investment strategies, will be the ones who will be able to deliver not only higher share prices but potentially more income.

A common-sense approach

To make this Wilson versus WCM and CIE less personal, I’d like you to think about this: Is the old-world income-chasing strategy of CIE appropriate for a listed investment company now in a new world of very low interest rates and shrinking dividends? I’d also add, that in this post Coronavirus world, the growth opportunities seem to be more likely to come from overseas rather than at home.

The history of innovative companies shows that as the world changes, forward-thinking boards adapt, which is what the board of CIE is proposing.

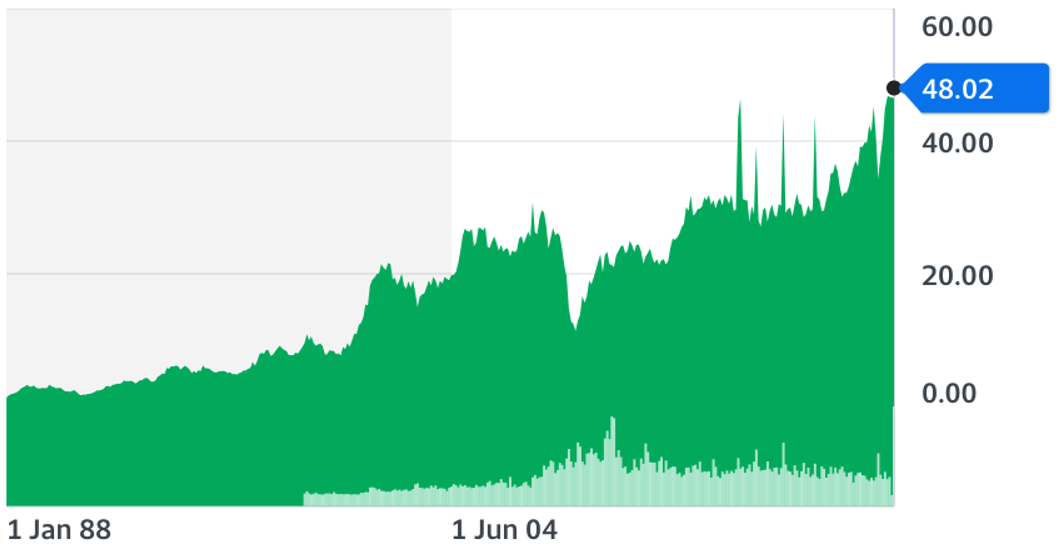

Many companies change their profit centres, as Wesfarmers has shown over time. Wesfarmers was founded in 1914 as a co-operative to provide services and merchandise to Western Australian farmers. It was listed in 1984 and grew into a major retail conglomerate. Yes, it changed its function and look at its success.

Wesfarmers (WES)

Wesfarmers recently exited supermarkets to look at better growth alternatives going forward, while retaining its jewel in the crown — Bunnings.

My personal view

It would be great if dividends were like they used to be but they’re not. Therefore, it makes sense for the board of CIE to go looking for a world-class manager with an appropriate strategy that can bolster capital growth in the current market environment. This becomes the basis of higher profits, out of which better dividends can be paid.

If you are a shareholder of CIE, you are being given a chance to invest with one of the world’s best fund managers in WCM. I suspect if the shareholders vote in favour of this innovative idea, the stock market will like that idea and it should be positive for the share price.

That would mean those shareholders who only want to invest for income somewhere else could get a better share price in exiting the stock. I’m also sure there will be many potential shareholders who would like a WCM long short strategy, especially at this stage in the investing cycle.

The stock market marks up management teams, with great track records, bringing a world-class product or service to market. That’s the way I view this change of strategy and investment manager for CIE.

Admission: Yes, I am a shareholder of CIE and CGA — Contango Asset Management. As a shareholder and commentator, if I thought Geoff Wilson could perform better than WCM, I would be duty-bound and honour-bound to say that. I think CIE, like Wesfarmers, needs a new basis for making profit, driving the share price higher and delivering some income along the way, especially in an age of expected low interest rates and squeezed dividends.

If you’re a shareholder, think about voting. Your vote is important

You can vote in favour of Resolution 1 online at the Company’s share registry, Computershare, by visiting http://www.investorvote.com.au and using the control number: 184 099.

Please note that proxies must be received by 10:00am AEST on Wednesday 16 September 2020.

1. As at 30 June 2020.

2. Data as at 30 June 2020 in AUD. Performance presented is net of fees and includes the reinvestment of all dividends and income. Inception date of the WCM Quality Global Growth Long Short Equity Strategy is 30 June 2014. Past performance is not indicative of future results.

3. Data as at 31 July 2020 in AUD. Performance presented is net of fees and includes the reinvestment of all dividends and income. Past performance is not indicative of future results. Inception date of WCM Global Growth Limited is 21 June 2017.

4. Data source: WCM Investment Management and Wilson Asset Management. (https://wilsonassetmanagement.com.au/). Data as at 30 June 2020. Performance of WCM strategies is presented in in AUD net of fees and includes the reinvestment of all dividends and income. Past performance is not indicative of future results.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.