Transition to retirement strategies are popular among DIY super trustees because they allow you to access your superannuation while still working, and when combined with an income swap strategy, there are some attractive tax benefits.

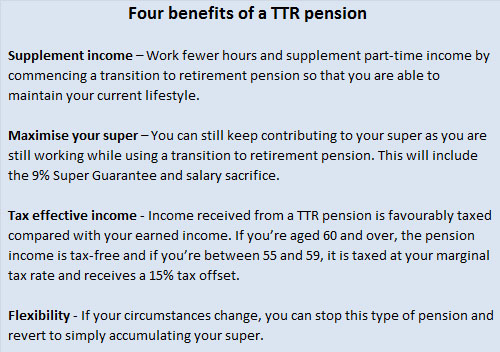

Transition to retirement (TTR) allows you to reduce your work hours by supplementing your wages with super pension income, providing you with a financially stable alternative to retiring permanently after attaining preservation age.

Two ways to use TTR

There are two key ways in which a transition to retirement pension can work:

A member may choose to continue working on a part-time basis, using part of their super to supplement their income instead of having to retire permanently from the workforce simply to access their superannuation;

Or

A member may choose to establish an effective salary sacrifice agreement with their employer whereby the member directs a portion of their pre-tax salary as additional contributions to superannuation, while at the same time accessing a TTR pension. This TTR income swap strategy has some attractive tax benefits.

The key benefit comes from moving current super benefits from the accumulation phase – an environment where income or earnings are taxed at 15% – in to the pension environment, where earnings are exempt from tax.

Is a TTR pension right for you?

Is a TTR pension right for you?

A TTR pension may be suitable if you’re aged between age 55 and 64, still working, want to supplement your income, or want to boost your super and save tax.

These seven points will help you decide whether or not a TTR pension will suit your circumstances.

Seven tips for using a TTR pension

1) Under a TTR strategy, you can access no more than 10% and no less than 4% of your super account balance in any one year.

2) Before beginning a TTR strategy you should make sure you have accumulated enough super to last for your full retirement – remember, we are all living for longer.

3) Income from a TTR pension is assessed as income for social security purposes. Some people may be better off not commencing a pension if social security entitlements are more important. Alternatively, for some commencing a pension that replaces salary and wages may improve social security entitlements under the income test as it will be treated more favourably due to the tax exempt amount.

4) Accessing large lump sum amounts under a TTR pension is restricted until age 65 or the until the earlier of an individual permanently retiring from the workforce before age 60 or resigning from a position while aged between 60 and 65 years.

5) The maximum amount that can be directly contributed from your salary to superannuation is $25,000 per annum (includes salary sacrifice and Superannuation Guarantee).

6) An effective salary sacrifice arrangement allows more superannuation monies to be accumulated for retirement. Salary sacrifice super contributions are taxed up to a maximum of 15% rather than a client’s marginal tax rate (which could be up to 46.5%, including the Medicare Levy).

7) Income from the TTR pension (when over age 60) won’t attract tax because it’s not counted as assessable income. Therefore your employment income won’t be pushed into a higher marginal tax bracket by your pension income.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.

Also in the Switzer Super Report

- Peter Switzer: Five stocks and a crystal ball

- James Dunn: Can CSL’s success story continue?

- JP Goldman: Emerging markets looking cheap

- Jo Heighway: Question of the week: trustee meetings