For some of us, the contribution caps were reduced at the start of this financial year, meaning the two basic limits are now the same for everyone regardless of age:

- Concessional (before tax): $25,000

- Non-concessional (after tax): $150,000

Is it ever worth breaking these caps?

The simple answer is no and I’ll show you why in a minute.

But there is one scenario where you can contribute more without technically breaking your cap and it’s called the ‘bring-forward’ rule. If you’re under age 65, you are able to bring forward two future years of non-concessional contributions totalling $450,000, as long as you don’t breach that limit within the three-year space.

There are a range of rules relating to this, so it’s important to get some advice as to the benefits to you.

How are the excess contributions treated, and is it worth putting in more than your cap?

Once you have reached your concessional cap (generally, those paid by your employer, like the 9% super guarantee and salary sacrifice), all other contributions should be made as non-concessional personal contributions (that is, personal contributions) up to those limits – never above.

The cap system works as follows:

1. Amounts up to the concessional cap are taxed in the super fund at the normal rate of 15%.

2. If an amount is above the concessional cap, the excess is taxed at a flat rate of 31.5%.

3. Therefore, with the two rates combined, the rate of tax on the excess amount is 46.5% regardless of what personal tax bracket you are in.

4. In addition, the excess amount is then counted towards your non-concessional cap. If you have already used up your non-concessional cap, the excess amount is taxed again at a flat rate of 46.5%. That amounts to tax of 93% on the original amount that broke the cap – not a pretty scenario.

The only people who aren’t additionally taxed on excess amounts are those in the top marginal tax bracket, with the excess amount not exceeding their non-concessional cap. Often, people in this tax bracket breach the $25,000 cap based on the compulsory employer-paid contributions.

The question is, why bother breaking your concessional cap?

It is exactly the same as only contributing money up to the concessional cap, then taking the balance as after-tax money and making a non-concessional contribution. Do it this way and there are no additional tax forms or excess notices to fill in, or any other paperwork for the tax office. It achieves exactly the same result.

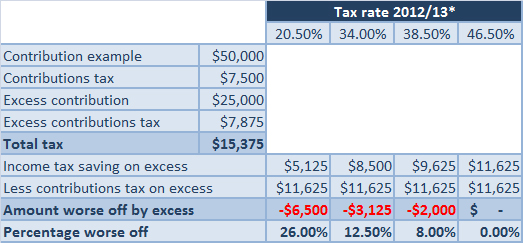

Based on my tax rate, what does the excess contributions tax cost me?

The excess amount is then counted towards the non-concessional cap. If you have used your full non-concessional limit, the excess amount will be taxed a second time at 46.5%. This would take the total tax rate to 93%.

Basic Rules

Do not contribute above your concessional cap.

Any amount that you want to put in that is greater than the concessional cap, contribute it as a non-concessional contribution and be mindful not to exceed the non-concessional cap.

Pending legislation

The 2012 Budget proposed that concessional contributions tax will increase from 15% to 30% for people with income over $300,000 in order to make the system fairer, ensuring tax incentives for super are equitable across different income brackets.

The analysis in this article has not taken into account this announcement as it has not yet been legislated.

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Anyone should consider the appropriateness of the information in regards to their circumstances.