Whilst not yet legislated, concessional contributions tax will increase from 15% to 30% for people with income over $300,000. This gives even greater importance to franking credits for these individuals seeking ways to reduce the tax increase. Instead of abandoning super, individuals may be looking at directing a portion of the self managed super investments into high-yielding, fully franked Australian shares to offset the increased contributions tax. However, additional considerations such as the risk profile of the SMSF members and the market performance will dictate whether this is a worthwhile strategy to pursue.

What are franking credits?

Australia has a dividend imputation system, which means that it acknowledges the amount of tax already paid by a company on profits, which is then paid out as a dividend to its shareholders. Shareholders are then required to pay tax on that dividend at their marginal tax rate. A franking credit, which is attached to the dividend, essentially refunds the amount of the company tax paid to avoid double taxation on the dividend.

Dividends have varying levels of franking. Some may be fully franked, meaning the full 30% company tax paid will be refunded, some partially franked, or unfranked.

Why are franking credits so beneficial in an SMSF?

Companies pay tax on income at 30%. The maximum amount of tax paid by an SMSF on income is 15%.

Therefore, when an SMSF receives a fully franked dividend in accumulation phase, the franking credit can offset the tax payable on the dividend by the SMSF, as well as tax payable on other income of the SMSF. This includes concessional contributions and capital gains tax. If the SMSF has no other income tax to offset, the ATO will refund the excess franking credit in cash.

In pension phase, where tax is reduced to 0%, the full amount of the franking credit may be refunded to the SMSF.

Minimising concessional contributions tax

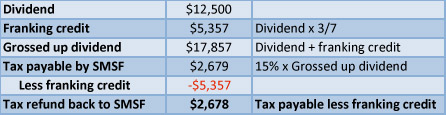

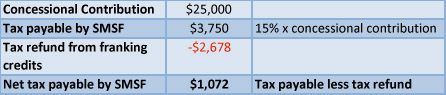

Concessional contributions are taxed at 15% to the SMSF. The following example shows how concessional contributions tax can be minimised using franking credits.

An SMSF has a share portfolio worth $250,000. The shares pay a fully franked dividend of $12,500 in FY 2012/13.

The SMSF received concessional contributions of $25,000 in FY 2012/13.

Using franking credits within the SMSF in this example, the concessional contributions tax has reduced from $3,750 to $1,072.

Another way to look at it is that the SMSF could receive concessional contributions of $17,853 (i.e. tax refund of $2,678/15% tax rate) before it pays contributions tax.

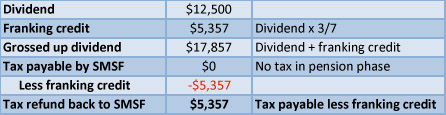

Franking credits in pension phase

Where the SMSF is solely in pension phase, and no contributions are made to the fund, the full amount of the franking credit may be refunded to the SMSF in cash. Using the same example as above:

In this case, the whole amount of the franking credit of $5,357 will be refunded to the SMSF as there is 0% tax when the fund is solely in pension phase. This is a welcome cash bonus to the SMSF.

Requirements to receive franking credits

To be entitled to franking credits, the SMSF must hold the shares ‘at risk’ for a certain period of time. For ordinary shares, this is at least 45 days, not counting the day of acquisition or disposal.

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Anyone should consider the appropriateness of the information in regards to their circumstances.