I’m 69 years old and purchased some shares in 2003 at the top of the market and given bad financial advice which I have tried to correct and take losses as a consequence. My wife and I since 2007 have run a SMSF which is in pension phase.

My question relates to 2 shares I have held for some time.

ARGO (ARG) total shares 7373 average price $7.909, on today’s price $6.990, yield at this price 3.85%.

TOll Holdings (TOL) total shares 3500 average price $9.649. On today’s price $5.31, yield at this price 4.91%.

Can I better invest these funds (about $70k available with losses of about $24k if I sell)?

Also your comments on FWD and MND would be appreciated.

Any advice you could give me would be very much appreciated.

Cheers

A: Good morning John,

Thanks for the question.

Argo is a listed investment company that over the long term, has produced pretty good investment returns that are closely correlated with the performance of the major stock market indices. This is no surprise since it largely invests in a diversified portfolio of the major stocks.

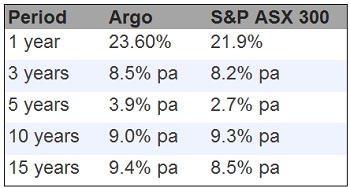

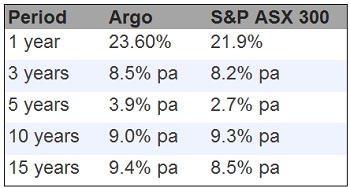

In fact, it has done better than the index it measures performance against ( the S&P/ASX 300 Accumulation), as the following table to 30 June demonstrates:

(Note: return assumes all Argo dividends are re-invested in Argo shares)

Toll Holdings, on the other hand, is a respectable industrial company. While it in the ASX top 50 stocks, its weighting in the S&P/ASX 200 is less than 0.30%.

A portfolio holding only Argo shares is diversified. A portfolio holding, say 50% in Argo and 50% in Toll Holdings, is not diversified.

Assuming that you want to keep roughly the same exposure to Australian equities, I would:

- keep your Argo shares; and

- either sell your Toll Holdings and buy more Argo shares; or

- keep a small parcel of Toll Holdings, and then buy other stocks around this to broaden your exposure to other sectors such as financials and telecommunications.

As you are in the pension phase, there are no issues around capital gains. You are not going to be able to access the capital loss, nor will you be paying any capital gains tax, so there is no reason why a “loss” or “profit” should be a consideration.

I don’t rate (or follow closely) FWD (Fleetwood) or MND (Monadelphous) – so I will leave that to others to comment.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.