Telstra’s full year profit result announced last Thursday was disappointing for three reasons.

Firstly, the dividend cut to 22c per share from FY18 was more than expected (I had forecast a cut to 25c). Moreover, the composition of the dividend going forward, which will include both an ordinary and a special component, means that the total dividend may be lower than 22c per share in FY20 and subsequent years.

Secondly, the extent of the NBN problem (read cost to Telstra) is bigger than feared. Telstra revised upwards the medium term impact that the NBN will have on Telstra’s earnings from a range of $2.0bn to $3.0bn per annum, to the top end of the range of $3.0bn per annum.

Finally, revenue growth remains a problem. At a guidance level, Telstra met its forecast with a 4.3% increase to $28.2bn. However, recurring core revenue grew by just 2.4%. On an EBITDA basis the picture is even worse, with recurring core EBITDA falling by 3.2%, in part due to the effects of the NBN which were estimated to cost $300m in FY17. Adding back the one-off NBN payments received in FY17 of a net $785m allowed Telstra to meet its guidance target of EBITDA growth of 4.5% to $11.2bn.

Some highlights

In all this gloom, there were a couple of highlights. Importantly, revenue from the key mobiles division rose in the second half compared to both the first half and the previous corresponding period. With signs that ARPU (average revenue per user) is stabilizing, Telstra was able to improve margin in the second half, with EBITDA increasing by almost $200m or 9% compared to the first half.

On a market share basis, Telstra continues to maintain ground. In the mobiles division, Telstra added 218,000 new customers. NBN share stands at 52%, with Telstra adding 676,000 new connections last financial year.

In regard to managing its cost base, Telstra’s underlying core fixed costs declined by $244m or 3.5%. It is also bringing forward the $1bn productivity target announced in November 2016 by one year and will now deliver this by FY20, and then increase this by a further $500m to drive annual productivity savings of $1.5bn by FY22.

The new dividend arrangements

From FY18, Telstra will pay an ordinary dividend of between 70% to 90% of ordinary earnings. Ordinary earnings exclude net one-off NBN receipts.

In addition, it will pay special dividends of 75% of future net one-off NBN receipts over time. To the end of the NBN migration period, this pool is estimated to be $4bn net of tax. If $3bn (75%) is returned to shareholders, this is equivalent to around 25c per share.

Next year, the sum of the ordinary and special dividend will be 22c per share (down from a total of 31c in FY17).

The challenge for Telstra is that as these one-off NBN payments are extinguished, how does it fill the gap? To maintain the dividend at 22c per share in FY22, Telstra will need to find another $1.0bn of EBITDA (assuming a 75% payout ratio). Clearly, there has to be some risk that the dividend of 22c will be cut again in the years’ ahead.

Monetizing the NBN

There are two streams of payments to Telstra from the NBN. Firstly, ongoing receipts for access to Telstra’s infrastructure (fibre, exchanges and ducts) which will increase in line with the roll out of the NBN. These will eventually reach just short of $1bn per annum on full migration, and continue until 2045.

The other receipts are one-offs of approximately $9bn, which are paid during the migration period. $1.5bn of this amount has already been received by Telstra. They partly, but not fully, compensate Telstra for giving up the business to the NBN. These receipts form the basis of the special dividend above.

Telstra is proposing to monetize part of the infrastructure receipts. The plan is to “sell” up to 40% of the total receipts that are ultimately expected, in exchange for an upfront cash payment which is expected to be $5.0 to $5.5bn. Telstra would retain an ownership interest in the monetization vehicle of about 25%, leaving the balance to repay debt (about $1.0bn) and support a capital management program to enhance shareholder returns, most likely through on and off market share buybacks.

Telstra hasn’t yet got all the consents and approvals in place for this financial engineering to proceed. This might be a good thing, because it is far from clear that this deal is in the best interests of shareholders (essentially exchanging future revenues for a payment now that can be used to reward current shareholders). The obvious question – if it is such a good deal, why would Telstra sell just 40% of the receipts (rather than 100%), and then bother to retain a 25% interest in the monetization vehicle?

What the brokers now say

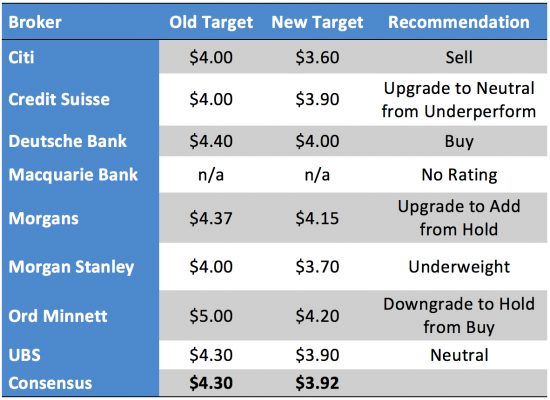

Following the announcement, each of the major brokers cut its forecast target price for Telstra. According to FNArena, the new consensus target price is $3.92 compared to $4.30 prior to the results. With the fall in share price, two brokers upgraded their recommendation, while Ord Minnett cut its rating from Buy to Hold and slashed its target price to $4.20. The table below shows the individual broker ratings.

In the main, the Brokers welcomed the cut to the dividend and the new capital management policy, seeing this as a necessary and prudent action that would strengthen the balance sheet, remove uncertainty and put earnings on a more sustainable path. Earnings forecasts were peeled back, in some cases by 10% to 15%, leading to the cut in the target price.

Morgans upgraded to Add and sees “upside risk”. Credit Suisse also upgraded to Neutral, noting that a “majority of the bad news is out of the way” and that “the dividend yield is sustainable for the next 5 years”. On the other hand, Deutsche is forecasting that the dividend is likely to fall in FY21, and Citi says that “rising NBN costs are expected to weigh heavily on earnings over the next 3 years and productivity gains only offer a partial offset.”

Bottom line

At $3.90, Telstra is yielding a prospective 5.64% fully franked. While the 22c dividend is probably locked in for the next 3 to 4 years, there has to be some risk that it could be cut again down the track.

When I last reviewed Telstra in July, I said that “income investors who are filling up on Telstra can afford to be patient, perhaps targeting the next buy level around $4.00”. I don’t wish to retract this statement, although the target of $4.00 is now a touch high.

One think is for sure, it is going to be some time before the market re-rates Telstra positively because growing revenue and cutting costs is hard in a super competitive consumer market. If the share market rallies, Telstra will lag and conversely in a bear market, be quite well bid for its income yield.

I continue to maintain that Telstra will do quite a lot of work either side of $4.00, but because a 5.6% fully franked yield is interesting but not compelling, my sense is that you can afford to be patient. There is no rush to buy.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.