The CommSec State of the States report, released on Monday, highlights the strength of the Western Australian economy. The state’s economic growth – as measured by state final demand plus exports minus imports – was 37% higher than the decade-average level of output and second only to the Northern Territory, which was 44%.

Western Australia had the highest retail trade growth for the December quarter, where spending was 25.5% above decade average levels.

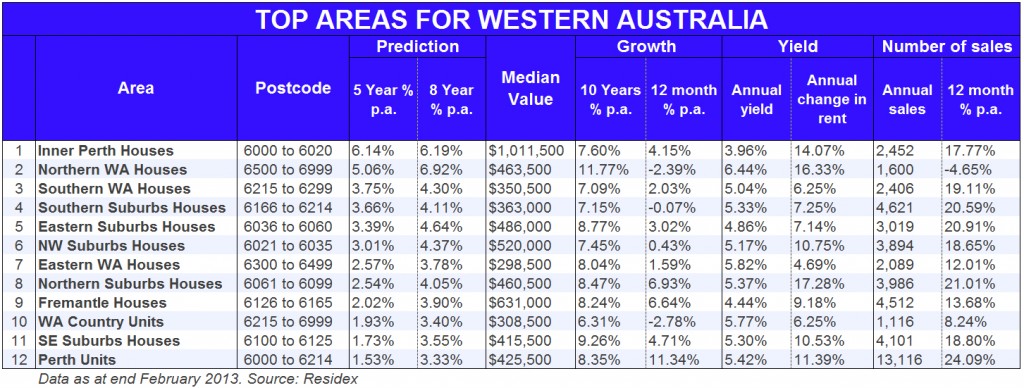

(Click table to enlarge)

It also boasts the highest equipment spending and population growth and was second only to the Northern Territory in construction work growth.

Western Australia’s growth is obviously attributable to its exposure to mining but despite talk of a slow down in the sector, economists like CommSec’s Craig James are forecasting the state’s growth to continue for at least the rest of this year.

For residential property that means continued strong growth in areas like inner Perth houses. House prices have been growing here at a rate of 7.6% per annum for the past 10 years and are forecast to grow at over 6% per annum for the next five years as well. The median house price is over $1 million and yields are solid at almost 4%, with strong increases in rent over the past 12 months. At $770, rent for inner Perth houses is higher than average rents for inner Sydney houses, which were $725 in February.

Perth units are not forecast to grow as strongly as houses in the area, but have still been enjoying solid growth over the past decade and are offering a higher yield, which is attractive to the investor. The average rent for Perth units in February was $440, which is higher than the $375 average for inner/north west units in Melbourne.

In the electoral district of Perth, over 60% of dwellings were houses, as at the last census, and 21.7% were flats, units or apartments. There was also a higher than average percentage of residents renting, at 35.9%, compared with 29.6% for the nation as a whole.

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.