A term deposit is an investment product that allows you to lock away some cash for a set period of time in return for a guaranteed return on your money. The guaranteed interest rate makes term deposits a low-risk investment, but they can also be a handy strategic tool. For example, they can be used to delay a large interest payment until the following tax year, or, if you believe interest rates are about to fall, you can move money into a term deposit in order to lock in the current interest rate.

Term deposits are cash deposits made with an Authorised Deposit Taking Institution (ADI), which includes the major banks, regional and online banks, building societies and credit unions. As the name implies, the money can’t be withdrawn before the end of the term – known as the maturity date – unless a penalty ‘break fee’ is paid.

Things to consider

There are four factors to consider before you open a term deposit:

- The security of the institution you plan to make the deposit with

- The interest rate and the term

- What happens at maturity – how easy it is to rollover, and at what rate?

- The interest payment frequency

As a general rule of thumb, the longer the term of the deposit, the higher the interest rate being offered.

Another factor you should be aware of is the margin on term deposits relative to the wholesale rates professionals in the money market pay, and the sustainability of that margin. In the wake of the global financial crisis, term deposit rates for retail investors have yielded extraordinary margins, as domestic banks have competed aggressively for retail funds.

The arguably absurd situation whereby a retail investor can get a rate of around 1% to 1.25% higher for a deposit of $50,000 than a wholesale investor can get from investing $100 million has been a common occurrence. While there is no immediate sign of this changing, you should be aware that this situation is unlikely to prevail in the long term and that if you are just relying on term deposits for your investment returns, you are taking on quite a considerable re-investment risk. A good idea is to keep an eye on the wholesale rate (usually referred to as the ‘bank bill rate’ or ‘bank bill swap rate’) – this will inform you as to what margin you are actually being offered.

How secure is my money?

All Australian deposit taking institutions are regulated by the Australian Prudential Regulation Authority (APRA). That said, different institutions have different capacities to withstand financial shocks and are accordingly rated differently. Typically, higher rated major banks are viewed as more creditworthy than minor or regional banks (or for that matter credit unions), and they don’t have to pay the same interest rate to attract funds as do lower rated institutions.

Tip: Following the global financial crisis, the government introduced a guarantee to protect deposits of up to $250,000 per investor per financial institution. So, your SMSF can effectively deposit up to $250,000 per ADI with the confidence that it carries a government guarantee. Accordingly, we suggest you place a low emphasis on the security factor for term deposits and focus on returns. If the size of the guarantee is less than the deposit, then security is certainly a consideration – the old adage that the ‘higher the risk, the higher the potential return’ should be applied.

When will I be paid interest?

Make sure to check how often you will be paid interest when comparing different term deposit offers. For example, a term deposit of 180 days that pays interest every 90 days at 6.45% per annum is a marginally better investment than a term deposit of 180 days at 6.5% per annum that only pays interest at maturity!

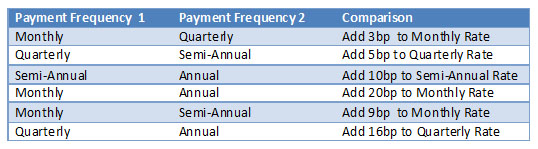

The rule-of-thumb that can be used to compare term deposits paying interest at different payment frequencies is as follows:

As stated above, a quarterly rate of 6.45% can be converted to a semi-annual rate by adding 5 basis points (or 0.05%) to the quarterly rate, so the equivalent semi-annual rate is 6.5%.

The power of compound interest

Compound interest is when you earn interest on your interest. Let’s work through an example. Suppose you invested $10,000 in a term deposit at 6.5% pa for 180 days with the interest to be paid on maturity. At the end of the deposit, your investment would be worth:

Maturity Amount = $10,000 x (1 + ((180/365) x (6.5/100))

= $10,000 x (1 + (.4931 x 0.065))

= $10,320.55

If the same $10,000 had been invested in a term deposit of 180 days that pays interest every 90 days at 6.45% pa and that interest is then reinvested, or it had been invested in two consecutive 90 day term deposits paying interest at 6.45% pa – allowing the interest to be compounded – then your investment would be worth:

Value at end of first 90 days = $10,000 x (1 + ((90/365) x (6.45/100))

= $10,000 x (1 + (.2465 x 0.0645))

= $10,157.81

Maturity Amount = $10,159.04 x (1 + ((90/365) x (6.45/100))

= $10,159.04 x (1 + (.2465 x 0.0645))

= $10,320.61

As you can see, the maturity amounts of both examples are about the same, even though the second case had a lower interest rate.

Rolling over your term deposit

When your term deposit reaches maturity, you can choose to take your money or roll it over into another term deposit. Apart from the inherent re-investment risk when rolling over a term deposit, be mindful of the “forgetful” investor syndrome. The so called “special rates” or “blackboard specials” can be a trap for the unwary when it comes time to roll over the term deposit.

While reminder notices are dispatched as your term deposit approaches maturity, the notice usually requires the investor to initiate some type of action. Unfortunately, some banks know that some investors will forget to act and structure their roll-over rates accordingly. If the investor does nothing, the default position is that your term deposit is automatically rolled over for the same term, often at an uncompetitive rate. The behavior of some of the banks here does border on the obscene – fortunately, a lot of the newer banks are far more customer focused and equitable in how they approach the rollover issue.

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.